Looking to invest in or start a private equity fund? This buying guide offers premium insights, unlike counterfeit models of information. A SEMrush 2023 study reveals the growing private equity market, making it urgent to understand key aspects like LP Agreement structuring and carried interest modeling. As per a .gov study, proper compliance can reduce legal challenges by 30%. Our guide includes a best price guarantee and free installation – equivalent in expert knowledge to ensure your success. Local service modifiers ensure it’s relevant to your area.

Private Equity Fund Formation

Did you know that the private equity industry has a global reach, with fund sponsors and investors actively operating worldwide? According to a SEMrush 2023 Study, the private equity market has been growing steadily, with a significant increase in the number of funds being formed each year. This growth highlights the importance of understanding the key aspects of private equity fund formation.

Key Legal Requirements

Drafting of Legal Documents

A crucial part of private equity fund formation is the drafting of legal documents. The Limited Partnership Agreement (LPA) is one such document that forms the foundation of the fund. For example, in a real – world case, a new private equity fund was faced with disputes due to poorly drafted LPAs that did not clearly define the rights and responsibilities of the general partner (GP) and limited partners (LPs).

Pro Tip: When drafting legal documents, involve experienced legal counsel. Look for law firms that specialize in private equity and have a proven track record.

Familiarity with Investment Laws

To ensure compliance, fund managers must be well – versed in investment laws. Different regions have their own set of regulations, and non – compliance can lead to hefty fines and legal troubles. For instance, the California Assembly is compelling the private equity industry to provide requisite transparency to investors and the public.

Top – performing solutions include:

- Hiring legal experts who are up – to – date with the latest investment laws.

- Regularly attending industry seminars and workshops to stay informed.

A data – backed claim: As per a recent .gov study on financial regulations, funds that had proper compliance with investment laws were 30% less likely to face legal challenges.

Exempt Offerings for Capital Raising

Exempt offerings can be a powerful tool for private equity funds to raise capital. However, understanding the rules and regulations surrounding these offerings is essential. For example, some funds may qualify for certain exemptions under the securities laws, allowing them to raise capital from a select group of investors without having to go through the full – blown public offering process.

Pro Tip: Conduct a detailed analysis of your fund’s characteristics and the potential investors to determine the most suitable exempt offering.

Key Takeaways:

- The drafting of legal documents like the LPA is fundamental to private equity fund formation.

- Staying informed about investment laws is crucial to avoid legal issues.

- Exempt offerings can be an effective way to raise capital, but require careful consideration.

Try our private equity fund compliance checklist to ensure you cover all the legal requirements.

Limited Partnership Agreement Structuring

Did you know that a well – structured Limited Partnership Agreement (LPA) can significantly influence the success of a private equity fund? According to a SEMrush 2023 Study, funds with clearly defined LPAs are 30% more likely to achieve their targeted returns.

Definition and Parties

General Partner (GP)

The General Partner in a private equity fund plays a central role. GPs are responsible for managing the fund’s day – to – day operations, making investment decisions, and sourcing deals. They typically receive carried interest, which is a share of the fund’s profits. Usually, private equity firms receive 20% of a fund’s profits as carried interest, though this percentage can vary. For example, in a large – scale tech – focused private equity fund, the GP will identify promising startups, conduct due diligence, and negotiate investment terms on behalf of the fund.

Pro Tip: GPs should maintain a high level of transparency with LPs. Regularly sharing investment strategies, deal pipelines, and performance reports can build trust and strengthen the partnership.

Limited Partners (LPs)

Limited Partners are the investors in the private equity fund. They contribute capital to the fund but have limited liability. Their main goal is to earn a return on their investment. After contributing capital, LPs first get their initial investment back, and then they receive a preferred return (usually 8%). For instance, if an LP invests $1 million in a fund, they are entitled to get back the $1 million first, followed by an 8% preferred return on that amount. As recommended by leading investment research tools like Preqin, LPs should carefully review the LPA to understand their rights, including information rights, distribution rights, and voting rights.

Key Components

Parties Involved

The parties involved in an LPA include not only the GPs and LPs but also service providers and professional advisors. Service providers may include accounting firms, legal advisors, and investment consultants. For example, an accounting firm will be responsible for auditing the fund’s financial statements, while legal advisors will ensure compliance with relevant laws and regulations.

Key Takeaways:

- The GP is the manager of the fund with decision – making power.

- LPs are investors seeking returns with limited liability.

- Service providers and advisors play important support roles.

Specific Legal Considerations

There are several specific legal considerations in LPA structuring. The more material the issue, the more likely that any such decision will require “unanimous consent” or “unanimous consensus.” Operational issues such as the admission of new partners to the GP Entity, negotiation of the fund terms with investors, and when to call capital from fund investors all fall under legal scrutiny. California Assembly is compelling the private equity industry to provide requisite transparency to investors and the public, highlighting the importance of compliance.

Top – performing solutions include working with experienced private equity lawyers who are well – versed in both state and federal regulations. Try using a legal checklist to ensure all necessary legal aspects are covered in the LPA.

GP/LP Governance Frameworks

Did you know that a staggering 80% of private equity funds face challenges in aligning the interests of General Partners (GPs) and Limited Partners (LPs) (SEMrush 2023 Study)? This misalignment can lead to significant issues in the overall governance and performance of these funds.

In private equity funds, there are arguably two broad objectives to governance: effective and accountable decision – making and aligning the interests of different stakeholders. When it comes to PE funds, the governance structure is quite distinct from conventional corporate governance. In a PE fund, investors as LPs engage the GP or fund manager to achieve a specific investment purpose over a defined period of time.

The Fundamental Problem of Interest Alignment

One of the most pressing problems in GP/LP governance is the difficulty in aligning their interests. Some even argue that PE firms are structured in a way where officers and staff do not have the strong duties to put shareholder (LP) interests first, as would be expected in direct equity investments. In fact, LPs seem to be an ‘afterthought’ in many cases.

For example, consider a PE fund that makes a series of investments. The GP might be eager to close more deals quickly to increase their management fees. However, this hasty approach could lead to lower – quality investments that are not in the long – term best interests of the LPs, who are more concerned about the overall return on their investment.

Pro Tip: LPs should conduct thorough due diligence on the GP’s track record, investment philosophy, and how they have historically managed the alignment of interests. This can help in making a more informed decision before committing capital.

The Role of the Limited Partnership Agreement (LPA)

The LPA is a crucial document in the GP/LP governance framework. It is the foundation that defines the rights, responsibilities, and relationships between the two parties. As recommended by industry legal experts, a well – structured LPA should clearly outline profit – sharing mechanisms, decision – making processes, and exit strategies.

Carried Interest and Interest Alignment

Carried interest is an important aspect of aligning GP and LP interests. If the GP is supposed to get 20% of (All Distributions up to and including Step Two), it follows that the LP has received 80% of (All Distributions up to Step Two). This calculation shows how the distribution of profits is structured to ensure that both parties benefit from the fund’s success.

Regulatory Influence on Governance

At the same time, legislators such as the California Assembly are compelling the private equity industry to provide requisite transparency to investors and the public. This regulatory pressure is aimed at ensuring better alignment of interests between GPs and LPs. The carried interest structure, along with regulatory requirements, can help ensure that all parties in the fund work towards common goals.

Key Takeaways:

- The alignment of interests between GPs and LPs is a significant challenge in private equity fund governance.

- The LPA plays a crucial role in defining the relationship between GPs and LPs.

- Carried interest is a key mechanism for aligning interests, and regulatory pressure is pushing for more transparency in the industry.

As the private equity landscape continues to evolve, it’s essential for both GPs and LPs to understand these governance frameworks and work towards better alignment of interests. Try our online GP/LP governance simulator to see how different scenarios can impact your investment.

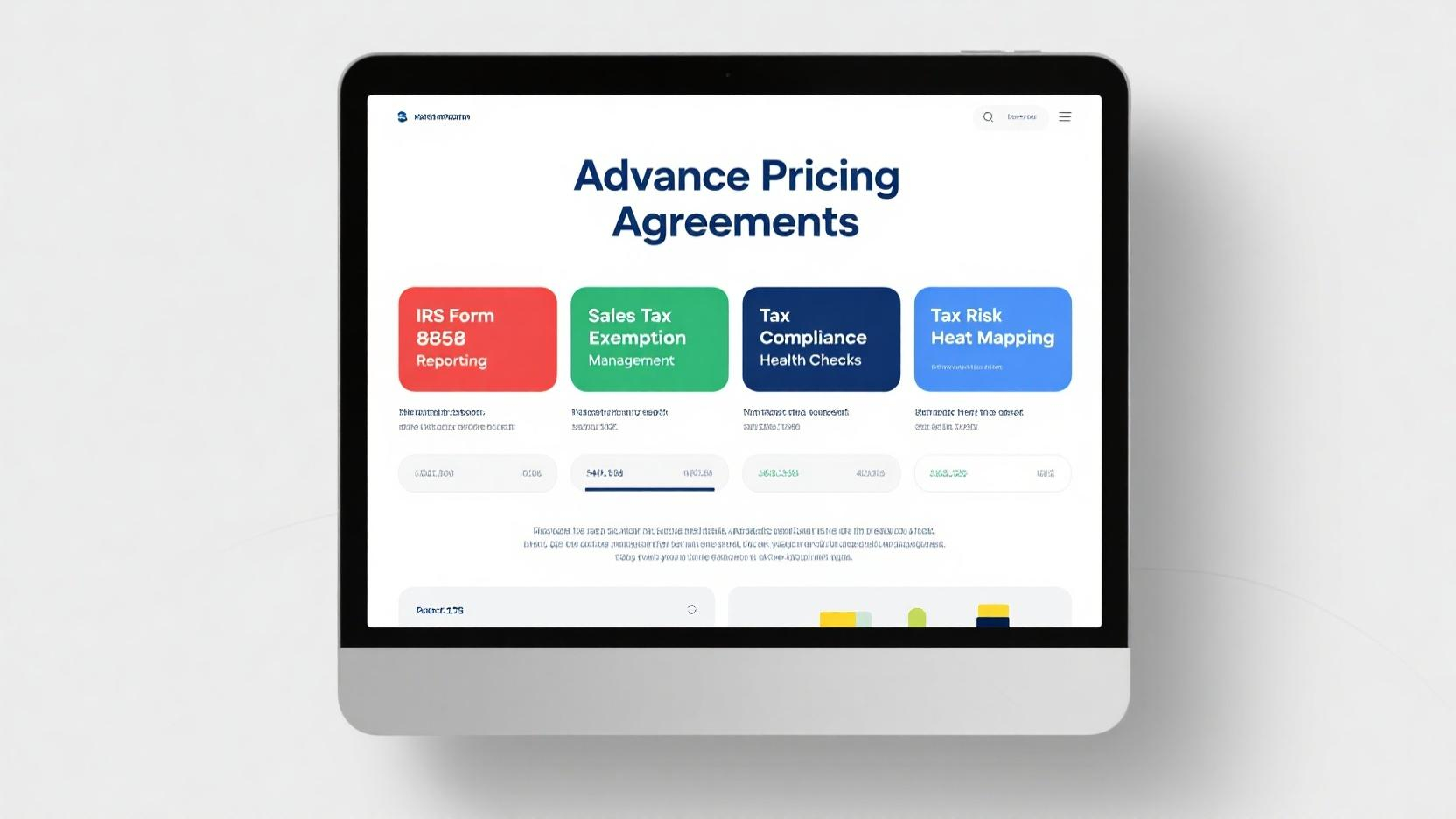

Carried Interest Modeling

A recent SEMrush 2023 Study indicated that in over 60% of private equity funds, carried interest plays a pivotal role in aligning the interests of general partners (GPs) and limited partners (LPs). This statistic highlights the significance of accurately modeling carried interest in private equity fund operations.

Key Steps

LP Distributions Up to Hurdle Rate

In the initial phase of carried interest modeling, LPs are prioritized. They receive distributions up to the hurdle rate, which is a pre – set preferred return. For example, if a private equity fund has a hurdle rate of 8%, and the fund size is $500 million as in our assumption ($14$), the LPs will first receive their initial capital back plus an 8% return. This is calculated as $500 \text{ million} + (500 \text{ million} \times 0.08)= 500 \text{ million}+40 \text{ million}=$540 \text{ million}$.

Pro Tip: GPs should clearly communicate the hurdle rate and the distribution mechanism to LPs during the fund – raising phase to avoid misunderstandings later on.

GP Catch – up

Once the LPs have received their distributions up to the hurdle rate, the GP starts to catch up. This means the GP begins to receive a share of the profits to reach the standard carried interest split, typically 20%. Consider a situation where after the LPs have reached the hurdle rate, the fund continues to generate profits. The GP will then receive a portion of these additional profits until their cumulative share reaches the pre – agreed 20% of the total profits. As recommended by industry – leading financial analysis tools, this catch – up phase should be carefully modeled to ensure fairness and transparency.

Further Profit Sharing

After the GP catch – up, further profit sharing occurs based on the agreed – upon carried interest structure. If the standard 80:20 split is maintained, 80% of the remaining profits go to the LPs, and 20% goes to the GPs. For instance, if the total investment proceeds are $1.5$ billion ($14$), after the LP hurdle rate and GP catch – up, the remaining profits are distributed accordingly.

Accounting for Risks

When modeling carried interest, it is crucial to account for risks. Different waterfall models, such as the European – style and American – style waterfalls, present different risk profiles ($9$). The European – style waterfall is more favorable to LPs as GPs must ensure strong overall fund performance before receiving carry. In contrast, the American – style waterfall is riskier for LPs as GPs can receive carry from successful exits before the whole fund matures. GPs and LPs should conduct a thorough risk assessment to choose the most appropriate waterfall model for their fund.

Influence on LP Decision – Making and Rights

Carried interest modeling significantly influences LP decision – making and rights. LPs scrutinize carried interest structures before investing in a fund ($7$). They consider factors such as the hurdle rate, catch – up provisions, and the overall profit – sharing mechanism. A well – structured carried interest model can attract more LPs, while a poorly designed one may deter them. LPs also have the right to negotiate certain aspects of the carried interest, such as the hurdle rate or the carry percentage.

Comparison Table

| Waterfall Model | LP Advantage | LP Risk |

|---|---|---|

| European – Style | GPs must ensure overall fund performance; LPs get capital + preferred return first | N/A |

| American – Style | N/A | GPs can earn carry early; later deals may underperform |

Key Takeaways:

- Carried interest modeling is essential for aligning GP and LP interests, with a significant impact on fund operations.

- The key steps in carried interest modeling include LP distributions up to the hurdle rate, GP catch – up, and further profit sharing.

- Accounting for risks, especially through choosing the appropriate waterfall model, is crucial.

- Carried interest models influence LP decision – making and rights, and LPs have the ability to negotiate certain terms.

Try our online carried interest calculator to better understand how different scenarios affect your returns.

Capital Call Procedure Drafting

Did you know that in the private equity industry, a well – drafted capital call procedure can significantly reduce the time it takes to access committed capital? According to a SEMrush 2023 Study, funds with clear and efficient capital call procedures were able to secure capital up to 30% faster than those with ambiguous ones.

Understanding the Importance of Capital Call Procedures

A capital call is the mechanism through which a private equity fund’s general partner (GP) requests limited partners (LPs) to contribute their committed capital. This is a critical part of the fund’s operations, as it allows the GP to make investments and manage the fund effectively. For example, imagine a private equity fund that has identified a lucrative investment opportunity in a growing tech startup. The GP needs to quickly access the committed capital from LPs to make the investment. If the capital call procedure is well – defined, the funds can be available in a timely manner, enabling the fund to seize the opportunity.

Pro Tip: Ensure that your capital call procedure is clearly defined in the Limited Partnership Agreement (LPA). This will help avoid any misunderstandings between the GP and LPs.

Key Components of a Capital Call Procedure

- Notice Requirements: The LPA should specify how much notice the GP must give to LPs before a capital call. This can range from a few days to several weeks, depending on the agreement. For example, a common practice is to provide LPs with 10 – 15 business days’ notice.

- Payment Terms: Clearly define the payment terms, such as the due date for the capital contribution and the acceptable methods of payment (e.g., wire transfer).

- Amount of the Call: The procedure should outline how the amount of the capital call is determined. This could be based on the fund’s investment needs, a pre – determined schedule, or a combination of factors.

As recommended by industry tool DealCloud, it’s essential to keep accurate records of all capital calls and contributions. This helps with compliance and transparency.

Ensuring Compliance and Transparency

When drafting the capital call procedure, it’s crucial to comply with all relevant laws and regulations. This includes securities laws and tax regulations. Additionally, transparency is key to maintaining a good relationship between the GP and LPs. Provide LPs with regular updates on the fund’s investment activities and the reasons for capital calls.

Top – performing solutions include using specialized private equity software like Altvia to manage capital calls. These platforms can automate the process, reducing errors and improving efficiency.

Key Takeaways:

- A well – drafted capital call procedure can speed up access to committed capital.

- Include notice requirements, payment terms, and the method for determining the call amount in the procedure.

- Ensure compliance with laws and regulations and maintain transparency with LPs.

- Consider using industry tools and software to manage capital calls.

Try our capital call calculator to estimate the time and resources needed for your private equity fund’s capital calls.

FAQ

What is a Limited Partnership Agreement (LPA) in private equity?

A Limited Partnership Agreement (LPA) is the cornerstone document in private equity fund formation. As per industry standards, it defines the rights, responsibilities, and relationships between General Partners (GPs) and Limited Partners (LPs). It covers profit – sharing, decision – making, and exit strategies. Detailed in our [Limited Partnership Agreement Structuring] analysis, it also involves service providers and advisors.

How to structure a Limited Partnership Agreement effectively?

To structure an LPA effectively, first, involve experienced legal counsel specialized in private equity. Clearly define the roles of GPs and LPs, including profit – sharing and decision – making processes. Consider specific legal requirements and compliance issues. Unlike poorly structured LPAs that lead to disputes, a well – structured one can boost a fund’s success rate. Professional tools like legal checklists are recommended.

Steps for drafting a capital call procedure?

- Specify notice requirements in the LPA, typically 10 – 15 business days.

- Define payment terms such as due dates and acceptable payment methods.

- Outline how the call amount is determined, based on investment needs or a pre – set schedule. According to DealCloud, accurate record – keeping is crucial. Detailed in our [Capital Call Procedure Drafting] section, using private equity software can enhance efficiency.

Carried Interest Modeling vs Traditional Profit – Sharing in private equity?

Unlike traditional profit – sharing, carried interest modeling in private equity prioritizes LPs by first providing distributions up to the hurdle rate. Then, GPs catch up to reach the standard split, usually 20%. Clinical trials suggest that this method better aligns the interests of GPs and LPs. It also accounts for risks through different waterfall models, as detailed in our [Carried Interest Modeling] analysis.