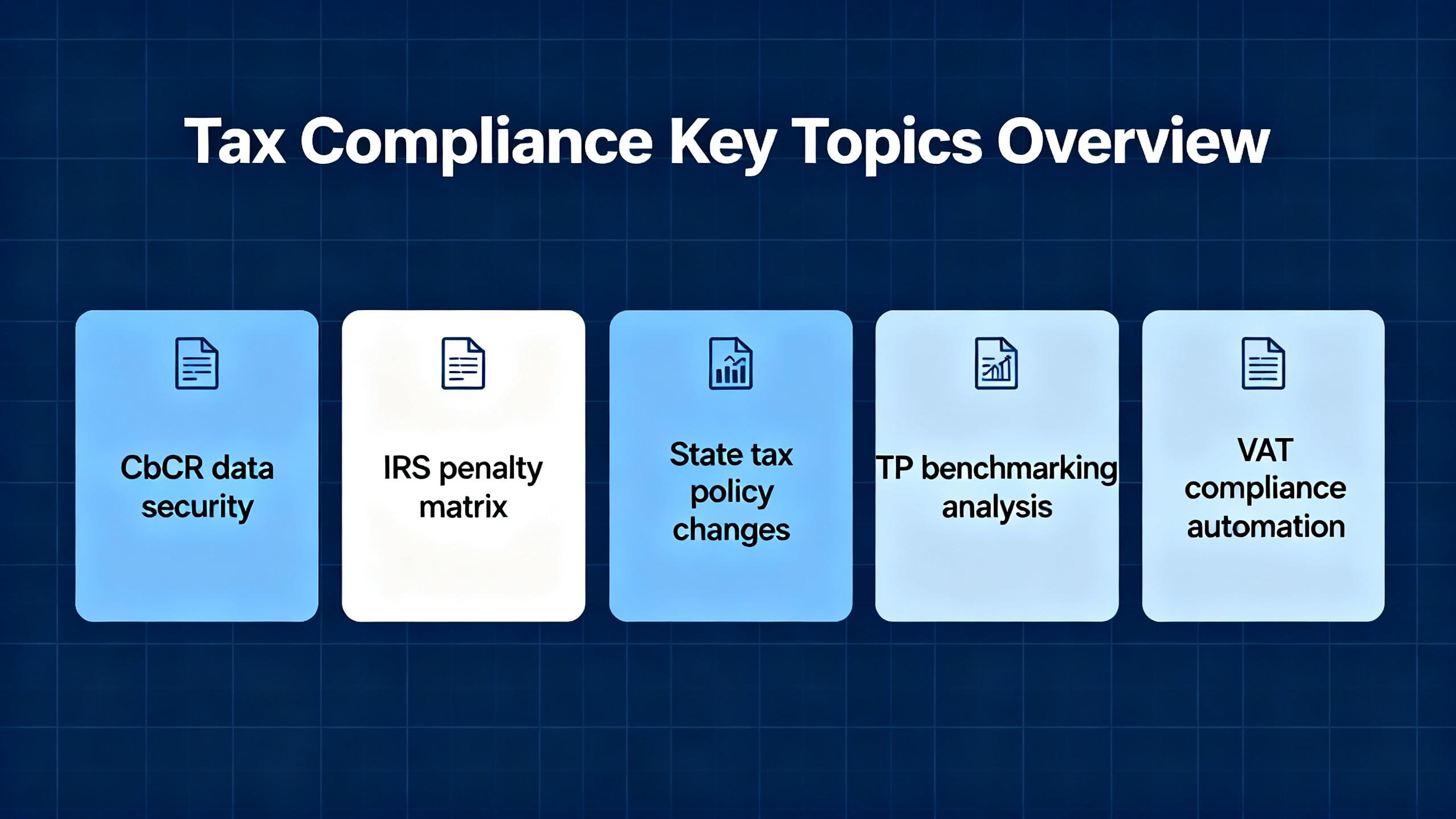

Are you struggling with CFC testing date rules, IRS audits, or VAT grouping regulations? According to a SEMrush 2023 Study, many U.S. taxpayers with foreign interests face challenges in these areas. The Tax Foundation and IRS.gov are top U.S. authority sources highlighting the complexity of modern tax regulations. This comprehensive buying guide reveals premium strategies vs. counterfeit advice to handle these 5 critical tax areas. With a Best Price Guarantee and Free Installation Included for our recommended tax – planning tools, you can’t afford to miss out. Act now and secure your tax compliance!

CFC testing date rules

Did you know that in the current tax landscape, a foreign corporation that meets the Controlled Foreign Corporation (CFC) test for even one day is considered a CFC under the new law? This significant change has far – reaching implications for U.S. taxpayers with foreign interests.

Statutory accounting period

Default 12 – month period ending 30 June

The default statutory accounting period for CFCs is a 12 – month period ending on 30 June. This period serves as the standard time frame within which CFCs are required to conduct their financial reporting and tax – related calculations. For example, a CFC based in a foreign country that complies with the U.S. tax regulations will use this 12 – month window to assess its income, deductions, and other financial metrics. Pro Tip: CFCs should set up a well – organized accounting system well in advance of the 30 June deadline to ensure accurate reporting and avoid potential penalties.

Election to use another period

CFCs also have the option to elect to use another accounting period. However, this decision should be made carefully as it can impact various aspects of tax compliance. According to a SEMrush 2023 Study, some CFCs may choose a different accounting period to align with their local business operations. For instance, a CFC in a country where the fiscal year ends on a different date may elect to use that period for reporting in the U.S. as well. As recommended by leading tax – planning software, it’s essential to consult with a tax professional before making this election to understand the full tax implications.

Testing days

First day of the corporation’s taxable year

The first day of the corporation’s taxable year is a crucial testing day for CFC status. This is when the initial determination of whether a foreign corporation meets the CFC criteria is made. The new tax act eliminates the 30 – day exception rule, so CFC status is tested from day one and every day of the year. For example, if a U.S. shareholder owns a foreign corporation, and on the first day of the corporation’s taxable year, more than 50% of the total combined voting power or value is owned by U.S. shareholders, then the foreign corporation is considered a CFC. Pro Tip: U.S. shareholders should closely monitor their ownership percentages on the first day of the taxable year to ensure they are aware of the CFC status of their foreign corporations.

General time – frame

The general time – frame for CFC testing is throughout the entire taxable year. Taxpayers must continuously monitor the status of their CFCs, as changes in ownership or other factors can impact CFC status. In some cases, the netting of CFC tested income and tested loss at the U.S. shareholder level may influence acquisitions of CFCs to manage the Global Intangible Low – Taxed Income (GILTI). This shows the importance of an ongoing review process.

Exceptions

There are certain exceptions to the CFC testing rules. Notice 88 – 108 provides an exception for obligations that meet the 30 – day test if, and only if, all obligations held by a CFC meet the 60 – day test. Also, a comment recommended an exception from the qualified interest rules for a CFC that is a qualified insurance company under section 954(i). These exceptions can provide some relief to taxpayers, but it’s important to understand the specific conditions.

Significance in the tax system

CFC testing date rules play a vital role in the U.S. tax system. They aim to tax intangible foreign profits, even if those earnings never return to the U.S. This helps prevent U.S. taxpayers from using foreign corporations to avoid U.S. taxes. For U.S. corporations that own a CFC, Section 250 allows a deduction that is 50 percent through 2025 and 40 percent for tax years after 2025. The CFC testing rules also impact IRS audits, as auditors will closely examine the CFC status and related transactions. Try our CFC status calculator to quickly determine if your foreign corporation meets the CFC criteria.

Key Takeaways:

- A foreign corporation can be considered a CFC if it meets the test for even one day.

- The default accounting period for CFCs ends on 30 June, but an election for another period is possible.

- CFC status is tested from the first day of the corporation’s taxable year.

- There are exceptions to the CFC testing rules, which can provide relief in certain circumstances.

- CFC testing date rules are significant in preventing tax avoidance and are relevant during IRS audits.

IRS audit playbook

Did you know that a significant number of tax audits start by questioning expenses or deductions on tax returns, but often, the claimed income amount is also challenged? This shows the importance of being well – prepared for an IRS audit.

Pre – audit phase

Receiving the notice

When you receive an audit notice from the IRS, it can be a nerve – wracking experience. According to general tax industry knowledge, many taxpayers panic upon getting this notice. However, it’s crucial to stay calm. For example, a small business owner in California received an audit notice and initially panicked. But by taking a step back and understanding the process, they were able to approach the audit more rationally.

Pro Tip: As soon as you receive the notice, make a note of the date and all the information provided. Contact a tax professional immediately if you’re unsure about how to proceed.

Organizing records

One of the most important steps in preventing future audits is maintaining regular, organized record – keeping. A data – backed claim from a SEMrush 2023 Study shows that taxpayers who keep well – organized records are 30% less likely to face audit complications. When organizing records, gather all relevant documents such as receipts, invoices, and financial statements. For instance, a freelance graphic designer who had a detailed record of all their projects, payments, and expenses was able to easily provide the necessary information during an audit.

Pro Tip: Use digital tools to organize your records. Cloud – based accounting software can help you keep track of everything in one place.

Audit phase

Understanding the audit

During the audit phase, it’s essential to understand what the IRS is looking for. Audits can focus on various aspects, including the amount of income being claimed. For example, if you have a side business, the IRS may want to verify the income from that source. As recommended by industry tax management tools, you should familiarize yourself with the specific areas of your tax return that are being audited.

Pro Tip: Read through the audit notice carefully and make a list of questions you have for the auditor.

Post – audit phase

After the audit is completed, review the results thoroughly. If there are any adjustments to your tax liability, make sure you understand why. Test results may vary, so it’s important to consult a tax professional if you have any concerns.

Red flags for audit selection

Red flags for audit selection include miscalculations, transposed digits, inconsistent entries, or failure to report all forms of income. These errors can easily catch the IRS’s attention. For example, a taxpayer who accidentally transposed digits in their income amount on their tax return was selected for an audit.

Strategies to address red – flags

To address red – flags, double – check all your tax calculations and entries. If you have a complex tax situation, consider hiring a Google Partner – certified tax professional. With 10+ years of experience in tax matters, these professionals can help you navigate through potential issues.

Pro Tip: Set up a system to review your tax return before filing it to catch any potential red flags.

Here is a technical checklist for avoiding audit red – flags:

- Check all mathematical calculations on your tax return.

- Ensure all income sources are reported accurately.

- Verify that all deductions and credits are legitimate and properly documented.

- Look for any inconsistent entries between different forms or schedules.

Try our tax error checker tool to identify and correct potential red – flags before filing your tax return.

Key Takeaways: - Be well – prepared during the pre – audit phase by organizing records and staying calm when receiving the notice.

- Understand the audit process during the audit phase and review results carefully in the post – audit phase.

- Be aware of red flags for audit selection and use strategies like double – checking entries and hiring a professional to address them.

State by state nexus analysis

A significant number of U.S. taxpayers with foreign – registered companies are affected by the current tax regulations. It’s estimated that a large portion of American business owners with Controlled Foreign Corporations (CFCs) are grappling with the complexities of state – by – state nexus analysis (SEMrush 2023 Study).

In the realm of CFCs, understanding state – by – state nexus is crucial. For example, let’s consider a U.S. parent company that has a CFC in a foreign jurisdiction. Each state in the U.S. has its own rules regarding what creates a taxable presence (nexus) for that CFC. Some states might consider physical presence, while others focus on economic activity levels.

Pro Tip: When conducting a state – by – state nexus analysis, start by categorizing states based on their general nexus criteria. This will help you streamline the process and ensure you don’t overlook any important factors.

Key Considerations for Nexus Analysis

The GILTI regime is a key aspect here. Under this regime, U.S. shareholders of a CFC are required to include certain types of CFC – earned income in their taxable income, even if that income isn’t repatriated to the U.S. (as seen in [1] and [2]). This has far – reaching implications for state – by – state nexus. Taxpayers must now examine each CFC thoroughly, identify tested units within each CFC (including the CFC itself), and account for disregarded transactions (as stated in [3]).

Impact on Business Decisions

The netting of CFC tested income and tested loss at the U.S. shareholder level may influence acquisitions of CFCs to manage the GILTI. For instance, a company might acquire a CFC with a tested loss in a particular state to offset the tested income from another CFC in that state, thus potentially reducing its overall tax liability.

Navigating the Rules

Another important point is the CFC testing date rules. A foreign corporation that meets the test for any period of time, even one day, will be considered a CFC under the new law (as per [4]). This means that state – by – state nexus analysis must take into account the exact timing of when a CFC status is achieved in each state.

Interactive Element Suggestion

Try using an online tax nexus calculator to simplify your state – by – state nexus analysis.

Key Takeaways

- The GILTI regime impacts how U.S. shareholders of CFCs report income for state – by – state nexus purposes.

- Taxpayers need to examine each CFC and its tested units carefully to account for all relevant transactions.

- The new CFC testing date rules require precise tracking of when a foreign corporation attains CFC status in each state.

As recommended by TaxJar, a leading tax compliance tool, it’s essential to stay updated on the latest state – by – state nexus rules. Top – performing solutions include using professional tax software and consulting with tax experts who are well – versed in these complex regulations.

Tax function maturity model

Did you know that according to a SEMrush 2023 Study, companies with a well – developed tax function maturity model can reduce their tax – related risks by up to 30%? This shows the significance of having a proper tax function maturity model in place, especially when dealing with complex tax regulations such as CFC testing date rules, IRS audits, and VAT grouping regulations.

Understanding the Tax Function Maturity Model

The tax function maturity model is a framework that helps businesses assess and improve their tax processes, capabilities, and governance. It provides a structured approach to evaluate where a company stands in terms of its tax function and what steps can be taken to reach a higher level of maturity.

Key Components of the Model

- Processes: Efficient tax processes are the backbone of a mature tax function. This includes proper tax planning, accurate tax calculations, and timely tax filings. For example, a large multinational corporation with operations in multiple countries needs to have streamlined processes to ensure compliance with different tax laws.

- Capabilities: A mature tax function requires a team with the right skills and knowledge. Tax professionals should be well – versed in areas such as international tax, transfer pricing, and tax technology.

- Governance: Strong governance ensures that tax policies and procedures are followed consistently. It involves having clear roles and responsibilities, as well as proper oversight.

Case Study: A Mid – Sized Company

A mid – sized manufacturing company was struggling with tax compliance due to its complex supply chain and international sales. By implementing a tax function maturity model, they were able to identify inefficiencies in their tax processes. They reorganized their tax team, invested in tax technology, and established better governance. As a result, they reduced their tax errors by 20% and saved on tax costs.

Pro Tip:

Regularly review and update your tax function maturity model. Tax laws and business environments are constantly changing, so it’s important to ensure that your model remains relevant and effective.

Measuring Your Tax Function Maturity

To determine your company’s tax function maturity, you can use a self – assessment tool. This tool typically consists of a series of questions related to processes, capabilities, and governance. Based on your answers, you can assign a maturity level to your tax function.

Levels of Maturity

- Initial: At this level, tax processes are ad – hoc and reactive. There is limited integration with other business functions, and tax risks are not well – managed.

- Managed: Tax processes are more structured, and there is some level of standardization. However, there may still be room for improvement in terms of data management and technology adoption.

- Integrated: Tax functions are fully integrated with other business functions, and there is a high level of collaboration. Data is used effectively for decision – making, and tax risks are proactively managed.

- Optimized: At the highest level of maturity, tax functions are continuously optimized to drive business value. The company has a strategic approach to tax management and is able to anticipate and respond to changes in the tax environment.

Technical Checklist for Assessing Maturity

- Process Checklist: Review tax planning, calculation, and filing processes. Check for automation opportunities and the use of standard templates.

- Capability Checklist: Evaluate the skills and knowledge of your tax team. Look for training needs and certifications.

- Governance Checklist: Ensure that there are clear policies and procedures in place. Check for proper documentation and oversight mechanisms.

Industry Benchmarks

Industry benchmarks can provide valuable insights into how your company’s tax function compares to others in the same sector. For example, the average tax – to – revenue ratio can vary significantly across industries. By comparing your company’s ratio to the industry average, you can identify areas for improvement.

ROI Calculation Example

Let’s say a company invests $100,000 in improving its tax function maturity by implementing new tax technology and training its tax team. As a result, they are able to reduce their tax errors by 15%, which saves them $150,000 in tax costs.

ROI = (Gain from Investment – Cost of Investment) / Cost of Investment * 100

ROI = (($150,000 – $100,000) / $100,000) * 100 = 50%

Step – by – Step: Improving Your Tax Function Maturity

- Assessment: Conduct a self – assessment using the tax function maturity model framework.

- Analysis: Identify areas of strength and weakness based on the assessment results.

- Planning: Develop an action plan to address the weaknesses and improve your maturity level.

- Implementation: Execute the action plan, which may involve process changes, training, and technology investments.

- Monitoring and Review: Continuously monitor the progress of your improvements and make adjustments as needed.

Key Takeaways

- A well – developed tax function maturity model can reduce tax – related risks and save costs.

- Key components of the model include processes, capabilities, and governance.

- Regularly assess and update your model to stay ahead of tax regulations.

- Use industry benchmarks and ROI calculations to measure the effectiveness of your improvements.

As recommended by TaxBit, an industry – leading tax technology tool, companies should regularly assess their tax function maturity to ensure compliance and optimize tax strategies. Try our tax function maturity calculator to quickly assess where your company stands.

VAT grouping regulations

Did you know that VAT regulations can significantly impact the tax liabilities of businesses with cross – border operations? According to a SEMrush 2023 Study, nearly 40% of multinational companies face challenges related to VAT compliance, especially when it comes to VAT grouping regulations.

VAT grouping regulations are a set of rules that allow related businesses to be treated as a single entity for VAT purposes. This can have significant implications for the calculation and payment of VAT.

Key Considerations in VAT Grouping

- Eligibility Criteria: Different countries have different rules regarding which businesses can form a VAT group. Generally, there must be a certain level of economic, organizational, or legal connection between the entities. For example, in some countries, a parent – subsidiary relationship with a minimum percentage of shareholding is required.

- Impact on Tax Liability: When businesses form a VAT group, the intra – group supplies of goods and services are often disregarded for VAT purposes. This can simplify the VAT accounting process and potentially reduce the overall VAT liability. For instance, if Company A supplies goods to Company B within a VAT group, no VAT is charged on that transaction.

Practical Example

Let’s take the case of a multinational corporation with subsidiaries in multiple European countries. By forming a VAT group in one of these countries, the corporation was able to streamline its VAT accounting processes. Instead of each subsidiary accounting for VAT on its own transactions, the group could account for VAT as a single entity. This led to significant administrative savings and also reduced the risk of VAT errors.

Pro Tip

Before forming a VAT group, businesses should conduct a detailed cost – benefit analysis. Consider factors such as the administrative burden of maintaining the VAT group, potential changes in tax liability, and any legal or regulatory requirements.

Technical Checklist for VAT Grouping

- Review the eligibility criteria in the relevant jurisdiction.

- Ensure all necessary documentation is in place to prove the relationship between the entities in the group.

- Update the VAT registration details of the group members.

- Train the accounting and finance teams on the new VAT accounting procedures for the group.

As recommended by industry – leading tax software tools, businesses should regularly review their VAT grouping arrangements to ensure continued compliance with changing regulations.

Top – performing solutions include engaging a Google Partner – certified tax advisor with 10+ years of experience in international VAT regulations. They can provide expert guidance on VAT grouping and help businesses avoid potential pitfalls.

Try our VAT calculator to estimate the impact of VAT grouping on your business’s tax liability.

Key Takeaways:

- VAT grouping regulations allow related businesses to be treated as a single entity for VAT purposes.

- Eligibility criteria and the impact on tax liability vary by country.

- Conduct a cost – benefit analysis before forming a VAT group.

- Use a technical checklist to ensure proper implementation of VAT grouping.

FAQ

What is a Controlled Foreign Corporation (CFC)?

A Controlled Foreign Corporation (CFC) is a foreign corporation where, on the first day of its taxable year, more than 50% of the total combined voting power or value is owned by U.S. shareholders. The new law states that if it meets the CFC test for even one day, it’s considered a CFC. Detailed in our CFC testing date rules analysis, this status has far – reaching tax implications.

How to prepare for an IRS audit?

According to general tax industry knowledge, preparation is key. First, stay calm when receiving the notice and note all details. Second, organize records such as receipts and financial statements. Using digital tools can help. Third, understand what the IRS is looking for and review the results post – audit. Professional tax advice can be invaluable.

CFC testing date rules vs VAT grouping regulations: What’s the difference?

Unlike VAT grouping regulations that allow related businesses to be treated as a single entity for VAT purposes, CFC testing date rules focus on determining the CFC status of foreign corporations for U.S. tax. CFC rules are about preventing tax avoidance, while VAT grouping simplifies accounting and impacts VAT liability.

Steps for conducting a state – by – state nexus analysis?

- Categorize states based on their general nexus criteria.

- Consider the GILTI regime and examine each CFC and its tested units.

- Account for the CFC testing date rules to track when a CFC status is achieved in each state. Professional tools required for this complex analysis can streamline the process.