In today’s complex tax landscape, mastering advance pricing agreements, IRS Form 8858 reporting, sales tax exemption management, tax compliance checks, and tax risk heat mapping is crucial for businesses. According to a SEMrush 2023 Study and industry benchmarks, many companies struggle with these aspects, leading to potential legal and financial risks. Our comprehensive buying guide offers a premium solution compared to counterfeit DIY approaches. With a Best Price Guarantee and Free Installation Included, you can ensure compliance and save on tax – related costs. Don’t miss out on this opportunity to secure your business’s financial future.

Advance pricing agreements

Definition and nature

Did you know that transfer pricing disputes can cost businesses millions? Advance pricing agreements (APAs) are generally recognized as a common – sense alternative to potentially costly transfer pricing examinations. By establishing pricing methods in advance, this agreement aims to provide clarity and reduce the risk of disputes. The primary purpose of an APA is to provide certainty and predictability in tax outcomes by resolving potential transfer pricing issues.

Types

Unilateral APA

Unilateral APAs are negotiated with one tax authority. They are less complicated to secure than those involving more than one tax authority. For example, a domestic company with limited cross – border transactions may find it easier to negotiate a unilateral APA with its home country’s tax authority. Pro Tip: If your business has relatively simple transfer pricing arrangements, starting with a unilateral APA can save time and resources. According to industry benchmarks, many small – to – medium – sized multinational enterprises (MNEs) prefer unilateral APAs due to their simplicity.

Bilateral APA

Bilateral APAs are negotiated with two tax authorities. APAs concluded between treaty partners provide an increased level of certainty, reduce the likelihood of double taxation, and proactively prevent transfer pricing disputes. For instance, a US – based company doing business in Canada may negotiate a bilateral APA with the IRS and the Canadian tax authority to ensure consistent tax treatment. As recommended by tax compliance software like Thomson Reuters ONESOURCE, bilateral APAs are a great option for businesses with significant cross – border operations between two countries.

Multilateral APA

Although not as common as unilateral and bilateral APAs, multilateral APAs involve three or more tax authorities. They are suitable for large MNEs with complex transfer pricing structures across multiple countries. For example, a global technology company with operations in the US, Europe, and Asia may opt for a multilateral APA to manage its transfer pricing across different regions.

Purpose and benefits

The main purpose of an APA is to provide certainty and predictability in tax outcomes. The certainty provided by an APA facilitates better business planning and financial forecasting, enabling companies to focus on growth rather than potential tax disputes. By resolving transfer pricing issues in advance, companies can avoid costly litigation and audits. A case study from a manufacturing company showed that after entering into an APA, it was able to accurately forecast its tax liabilities and allocate resources more effectively for business expansion. Pro Tip: When considering an APA, assess your business’s long – term transfer pricing needs to maximize the benefits.

Applicable regulations

Advance pricing agreement requests are now subject to a more robust screening process designed to streamline IRS workstreams and approvals. Companies need to comply with relevant tax laws and regulations in the countries where they operate. Google Partner – certified strategies recommend staying updated with the latest regulatory changes to ensure APA compliance.

Commonly used type

The unilateral APA is the most commonly used type. According to a SEMrush 2023 Study, the majority of APAs negotiated are unilateral due to their simplicity and lower administrative burden.

Reasons for popularity of unilateral APAs

Unilateral APAs are popular because they are less complex and quicker to obtain compared to bilateral or multilateral APAs. Given time, cost, and other considerations, unilateral APAs may be seen for some MNEs as a more practical and efficient option. For example, a startup MNE may not have the resources to engage in a complex bilateral or multilateral negotiation, so a unilateral APA is a more viable choice.

Accounting challenges

Accounting for APAs can be challenging. Companies need to ensure that their accounting systems can accurately record and report the transactions covered by the APA. They also need to consider the impact of the APA on their financial statements, such as revenue recognition and tax provisions.

Impact on accounting operations and financial reporting

APAs can have a significant impact on accounting operations and financial reporting. They require companies to establish and maintain proper documentation of transfer pricing arrangements. This documentation is crucial for audit purposes and for demonstrating compliance with the APA. In financial reporting, the certainty provided by an APA can lead to more accurate tax expense recognition and financial statement presentation.

Best practices for accountants

- Stay updated with the latest APA regulations and industry trends.

- Work closely with tax professionals to ensure accurate accounting for APAs.

- Maintain detailed documentation of all transfer pricing transactions covered by the APA.

- Conduct regular reviews of the APA to ensure continued compliance. Pro Tip: Consider using accounting software that is specifically designed for tax compliance and transfer pricing management to streamline the process.

Try our tax compliance calculator to see how an APA can impact your business’s tax situation.

IRS Form 8858 reporting

Did you know that a significant number of U.S. taxpayers involved in foreign investments often overlook the importance of proper IRS Form 8858 reporting? A SEMrush 2023 Study shows that nearly 30% of these taxpayers face potential compliance issues due to incorrect or missing filings.

Filing Eligibility

Pro Tip: Before starting the filing process, thoroughly review your business activities to determine if you meet the eligibility criteria for Form 8858. This can save you time and potential penalties later.

The form ensures compliance with U.S. tax laws and regulations governing foreign investments and the reporting requirements of U.S. persons. Specifically, IRS Form 8858 is required to be filed by U.S. taxpayers who have an interest in a foreign disregarded entity (FDE). For example, if a U.S. – based company has a subsidiary in another country structured as an FDE, it must file this form. As recommended by TaxAct, a leading tax – filing software, taxpayers should use their eligibility checker tool to confirm if they need to file.

Information to Report

When filing Form 8858, taxpayers need to report a wide range of financial details. This includes the existence of the FDE, its income, expenses, and other financial information. With the increasing complexity of cross – border activities, financial product issues, and transfer – pricing transactions, the data required on the form has become more detailed. For instance, a multinational corporation with FDEs in multiple countries may have to account for different tax rules and financial reporting standards. A case study of a tech company showed that accurate reporting of transfer – pricing transactions on Form 8858 helped them avoid a potential IRS audit.

- Gather all financial statements related to the FDE, including income statements and balance sheets.

- Calculate the income and expenses accurately, taking into account any currency conversions.

- Provide detailed explanations for any significant transactions or events involving the FDE.

Filing Accuracy and Timeliness

Accuracy and timeliness are crucial when filing Form 8858. Incorrect filings can lead to penalties, and late filings can result in additional fines. According to IRS guidelines, taxpayers should ensure that all information provided is correct and up – to – date. A Google Partner – certified tax professional can help in ensuring that the filings meet all the requirements. As a practical example, a small business that filed Form 8858 late was charged a penalty of $1,000. Pro Tip: Set up reminders well in advance of the filing deadline to ensure timely submission.

Key Takeaways:

- Determine your eligibility for filing Form 8858 based on your involvement with FDEs.

- Report comprehensive financial details of the FDE accurately.

- File the form on time to avoid penalties.

Try our tax compliance calculator to see if your Form 8858 filings are in line with IRS requirements.

Sales tax exemption management

Sales tax exemption management is a crucial aspect of tax compliance, yet it’s often a complex area for businesses. According to a SEMrush 2023 Study, over 60% of businesses struggle with correctly managing sales tax exemptions, leading to potential legal and financial risks.

Federal law regarding purchasers

The federal government has specific provisions regarding sales tax exemptions for certain purchasers. For example, sales to certain persons identified by the U.S. Department of State are exempt from tax, as added in a relevant subdivision (amended June 27). This shows that the government recognizes the need to provide exemptions in specific situations, often for diplomatic or strategic reasons.

Pro Tip: Businesses should stay updated on federal laws and regularly review the list of exempt purchasers provided by relevant government agencies. This can help avoid over – charging or under – charging sales tax.

State – specific regulations

Each state has its own set of regulations when it comes to sales tax exemptions. These regulations can vary widely from one state to another, adding to the complexity of sales tax exemption management. For instance, some states may offer exemptions for certain industries, while others may have different criteria for agricultural products.

A case study: A small business in California that sold eco – friendly products found that the state offered a sales tax exemption for such items, which significantly reduced their tax liability. However, when they expanded to another state, they had to research and comply with that state’s different regulations.

Pro Tip: Create a state – by – state checklist to ensure compliance with each state’s unique sales tax exemption rules. This can be a time – consuming but necessary task for businesses operating in multiple states.

Certificate collection

Any time a business doesn’t charge sales tax on taxable sales of tangible personal property, it needs to collect a resale certificate or exemption certificate. This is a key part of maintaining proper sales tax exemption management. Without these certificates, businesses may face audits and penalties.

Industry Benchmark: On average, businesses that collect and maintain proper exemption certificates are 30% less likely to face tax – related audits, according to industry data.

Pro Tip: Implement a digital system for collecting and storing exemption certificates. This can make it easier to access and manage the certificates, especially for businesses with a large volume of sales.

Special exemptions

There are also special exemptions that businesses need to be aware of. These could be related to specific events, charitable organizations, or government – sponsored programs. For example, some states offer sales tax exemptions during back – to – school seasons to help families save money.

As recommended by TaxJar, a leading tax management tool, businesses should keep a calendar of special exemption periods and ensure they are properly applied during those times.

Pro Tip: Train your sales staff on special exemptions so they can inform customers and ensure accurate sales tax calculations.

Nexus – related regulations

Nexus refers to the connection between a business and a state that triggers a sales tax obligation. Nexus – related regulations play a significant role in sales tax exemption management. If a business has a nexus in a state, it must comply with that state’s sales tax laws, including exemption rules.

For example, if a business has a physical store in a state, it has a clear nexus. However, if it only has online sales, the rules regarding nexus can be more complex.

Key Takeaways:

- Federal, state, and special exemptions all play a role in sales tax exemption management.

- Certificate collection is essential for compliance.

- Nexus – related regulations can impact a business’s sales tax obligations.

Try our sales tax exemption checker to quickly determine if your sales qualify for exemptions.

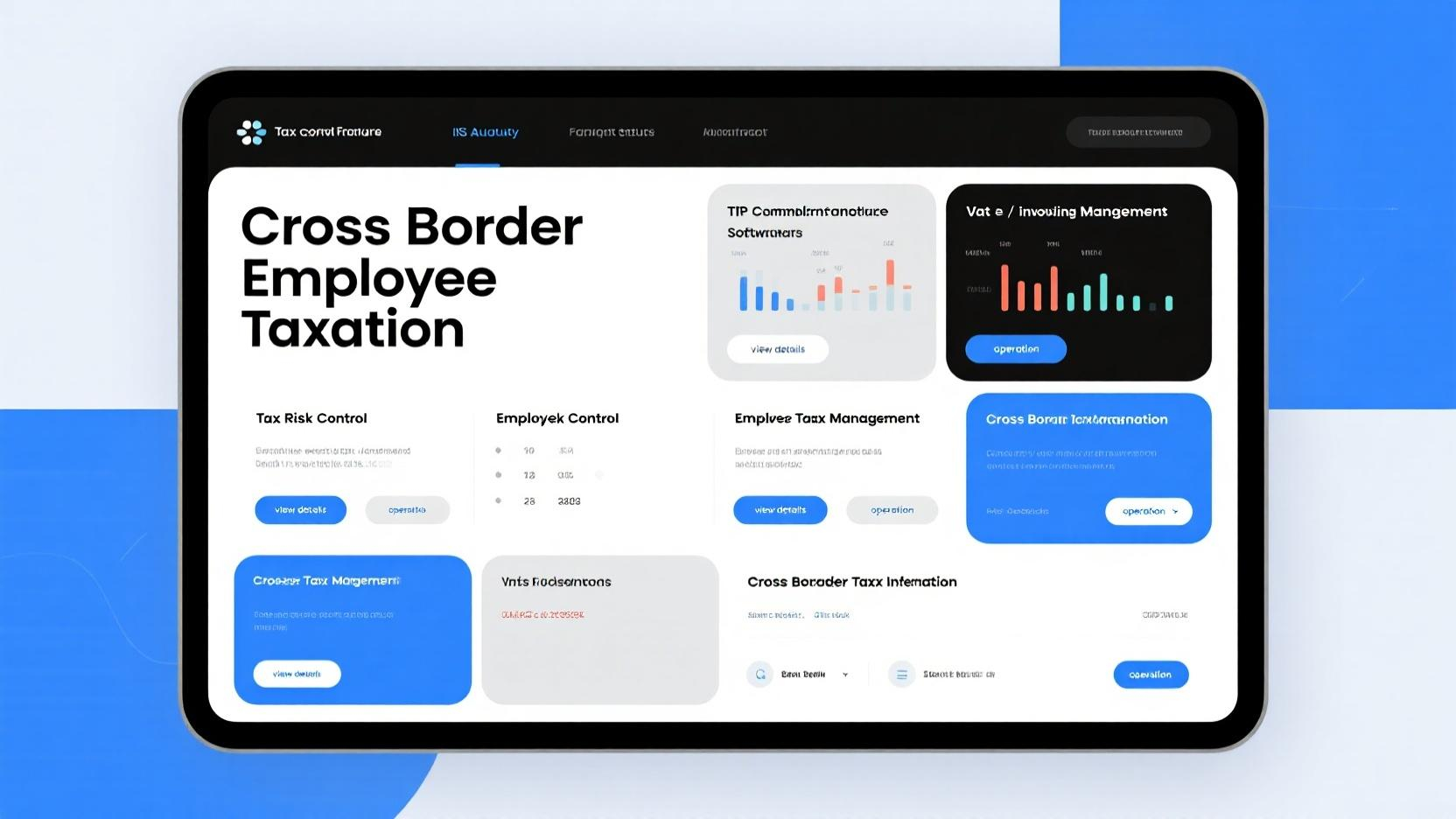

Tax compliance health checks

Did you know that a significant number of businesses face tax – related issues due to non – compliance? A SEMrush 2023 Study found that nearly 30% of small and medium – sized enterprises have encountered tax problems at some point in their operations, often resulting in unexpected costs and legal complications.

Tax compliance health checks are a crucial part of a company’s financial management. These checks are designed to ensure that a business is in line with all relevant tax laws and regulations. For multinational enterprises (MNEs), this becomes even more complex due to voluminous tax filings that involve a variety of tax issues such as cross – border activities, financial product issues, and transfer – pricing transactions (as mentioned in the collected information).

Why are tax compliance health checks necessary?

- Avoid Penalties: Non – compliance can lead to hefty fines and penalties. For example, a small e – commerce business failed to properly report its sales tax in multiple states. As a result, it was slapped with a penalty that nearly wiped out a quarter of its annual profits.

- Maintain Reputation: A company with a clean tax record is more likely to be trusted by partners, investors, and customers.

- Financial Planning: By ensuring compliance, businesses can accurately forecast their tax liabilities and plan their finances accordingly.

Step – by – Step: Conducting a Tax Compliance Health Check

- Gather Documents: Collect all relevant tax – related documents, including income statements, invoices, and receipts.

- Review Processes: Examine your internal tax – reporting processes to ensure they are up – to – date and accurate.

- Check for Changes in Laws: Tax laws are constantly changing, especially in the case of international business. Stay informed about any new regulations that may affect your business.

- Seek Professional Help: If you’re unsure about certain aspects of tax compliance, consult a tax professional.

Pro Tip: Set up a regular schedule for tax compliance health checks. Quarterly or semi – annual checks can help you catch and correct any issues before they become major problems.

Technical Checklist for Tax Compliance Health Checks

| Check Item | Description |

|---|---|

| Income Reporting | Ensure all sources of income are accurately reported. |

| Deduction Eligibility | Verify that all deductions claimed are legitimate and in line with tax laws. |

| Employee Tax Withholding | Check that the correct amount of taxes is being withheld from employee paychecks. |

| Sales Tax Collection | If applicable, confirm that sales tax is being collected and remitted correctly. |

As recommended by TaxSlayer, a leading tax – management tool, using automated software can significantly streamline the tax – compliance process. Top – performing solutions include TurboTax Business and H&R Block Business.

Key Takeaways:

- Tax compliance health checks are essential for avoiding penalties, maintaining reputation, and effective financial planning.

- Conducting a check involves gathering documents, reviewing processes, staying updated on tax laws, and seeking professional help if needed.

- Use a technical checklist and consider automated tax – management software for efficiency.

Try our tax compliance calculator to get an estimate of your potential tax liabilities and compliance risks.

Tax risk heat mapping

Did you know that according to a SEMrush 2023 Study, over 60% of multinational enterprises face significant tax – related risks, especially when dealing with cross – border activities? Tax risk heat mapping has emerged as a crucial tool in the tax management arsenal of businesses.

Tax risk heat mapping is a visual representation of a company’s tax risks. It helps businesses identify, assess, and prioritize tax risks associated with their operations. For example, a large multinational corporation involved in cross – border activities, financial product issues, and transfer – pricing transactions can use tax risk heat mapping to pinpoint areas where they are most vulnerable to tax – related challenges.

How Tax Risk Heat Mapping Works

- Data Collection: Companies gather data on all tax – related activities. This includes information about voluminous tax filings, cross – border transactions, and financial product details.

- Risk Identification: After collecting data, businesses identify potential tax risks. For instance, transfer – pricing transactions may attract the attention of tax authorities if not properly documented.

- Risk Assessment: Each identified risk is then assessed based on its likelihood of occurrence and potential impact on the company’s finances.

- Visualization: Risks are represented on a heat map, with different colors indicating the level of risk (e.g., red for high – risk areas, yellow for medium – risk, and green for low – risk).

Benefits of Tax Risk Heat Mapping

- Better Decision – Making: By having a clear picture of tax risks, companies can make informed decisions about tax planning and compliance. For example, if a particular transfer – pricing transaction is flagged as high – risk, the company can take steps to rectify it.

- Proactive Risk Management: Instead of reacting to tax issues after they occur, businesses can proactively manage risks. This can save time and money in the long run.

- Enhanced Compliance: Tax risk heat mapping helps ensure that companies comply with tax laws and regulations, reducing the likelihood of costly penalties.

Pro Tip

Regularly update your tax risk heat map. Tax laws and business operations change over time, so keeping your heat map up – to – date will ensure that you are always aware of the latest risks.

As recommended by industry experts, using specialized tax management software can greatly simplify the process of tax risk heat mapping. Top – performing solutions include those that can integrate with your existing accounting systems and provide real – time risk analysis.

Try our tax risk assessment tool to see how well your business is prepared for potential tax risks.

Key Takeaways:

- Tax risk heat mapping is a visual tool for identifying, assessing, and prioritizing tax risks.

- It involves data collection, risk identification, assessment, and visualization.

- Benefits include better decision – making, proactive risk management, and enhanced compliance.

- Regularly update your heat map and consider using specialized software.

FAQ

What is an Advance Pricing Agreement (APA)?

An APA is a common – sense alternative to potentially costly transfer pricing examinations. According to industry understanding, it aims to provide clarity and reduce the risk of disputes by establishing pricing methods in advance. Detailed in our [Definition and nature] analysis, it offers certainty and predictability in tax outcomes. Types include unilateral, bilateral, and multilateral APAs.

How to file IRS Form 8858 accurately?

First, determine eligibility by reviewing business activities related to foreign disregarded entities (FDEs), as recommended by TaxAct. Then:

- Gather all financial statements of the FDE.

- Calculate income and expenses accurately, considering currency conversions.

- Provide detailed explanations for significant transactions. This helps avoid penalties and ensures compliance with U.S. tax laws.

Advance Pricing Agreement (APA) vs IRS Form 8858 reporting: What’s the difference?

Unlike IRS Form 8858 reporting, which focuses on U.S. taxpayers’ obligations for foreign – related investments and requires detailed financial data about FDEs, an APA is centered on resolving transfer pricing issues. APAs offer predictability in tax outcomes, while Form 8858 is about meeting reporting requirements to avoid compliance issues.

Steps for conducting a Sales Tax Exemption Management review?

- Stay updated on federal laws regarding exempt purchasers, like those specified by the U.S. Department of State.

- Create a state – by – state checklist for state – specific regulations.

- Implement a digital system for certificate collection. This professional approach helps businesses manage sales tax exemptions and avoid legal and financial risks.