Stay ahead in 2023’s complex tax landscape with our comprehensive buying guide! The IRS has a new focus on large corporations, partnerships, and wealthy individuals, as per internal IRS announcements. A SEMrush 2023 Study also shows that unreported income is a major audit trigger. With the inclusion of 3,700 new employees, audits are set to intensify. Compare premium tax strategies to counterfeit models for better savings. Get a Best Price Guarantee and Free Installation Included on our tax tools. Don’t miss out!

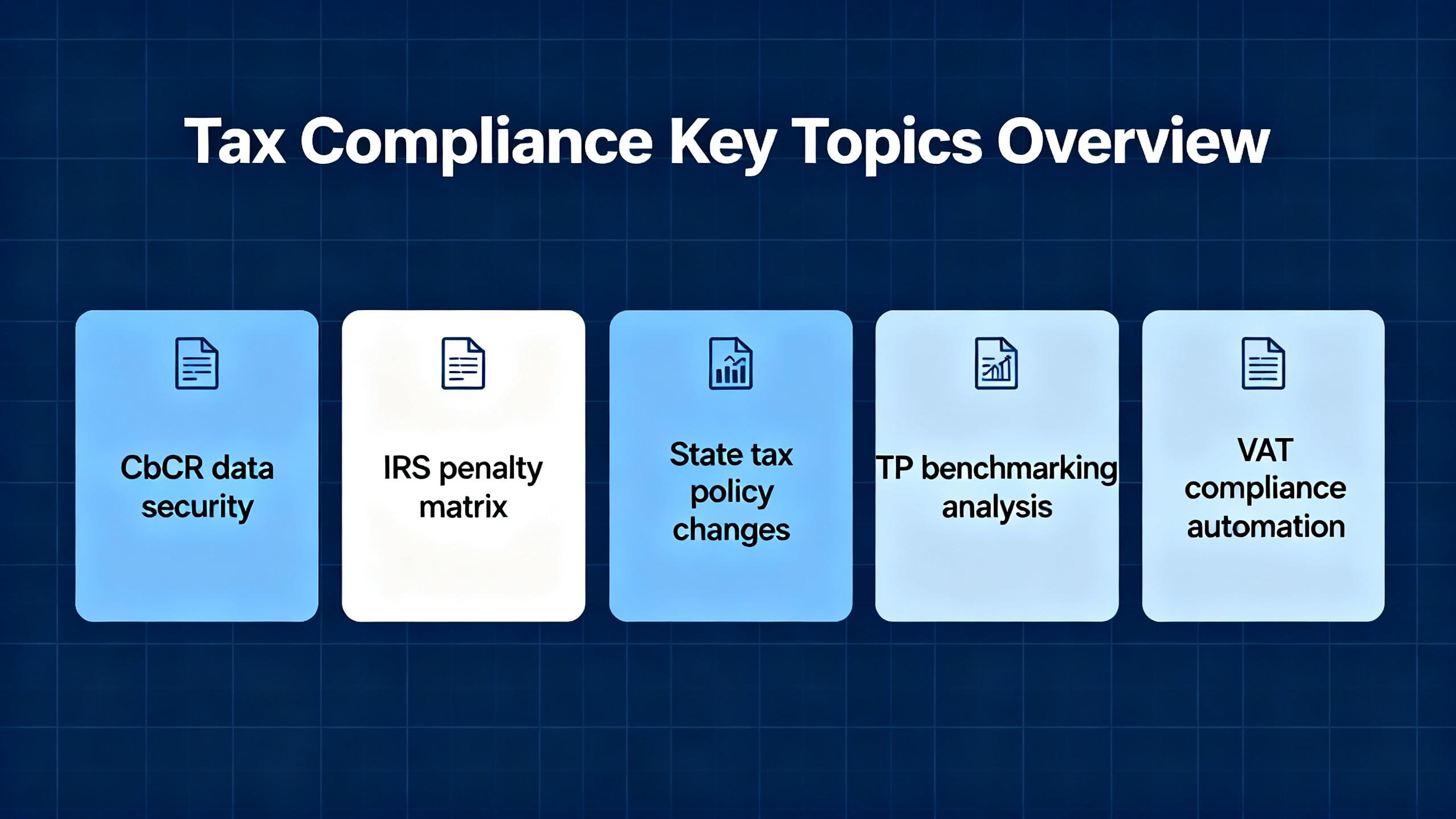

IRS audit trends 2023

Did you know that the IRS has announced a major push to focus upcoming audits on wealthy individual taxpayers, large corporations, and partnerships? In fact, with 3,700 new employees, the increased audit activity will target complex partnerships, large corporations, and high – net – worth individuals (Source: Internal IRS announcements). This section will delve into the key IRS audit trends for 2023.

Common audit triggers

Unreported income

Unreported income is one of the most common audit triggers. The IRS receives information from various sources, such as employers, banks, and investment firms. For example, if you work a side gig and receive a 1099 form but don’t report that income on your tax return, the IRS will likely notice the discrepancy. Pro Tip: Keep detailed records of all your income sources, including freelance work, rental income, and investment dividends. Always double – check that you’ve reported all income on your tax return. According to a SEMrush 2023 Study, a significant number of audit cases stem from unreported income, as the IRS has advanced data – matching systems to catch such discrepancies.

High deductions compared to earnings

If your deductions seem disproportionately high compared to your reported earnings, it can raise a red flag. For instance, a self – employed individual who claims a large amount of business – related deductions but has relatively low business income might draw the IRS’s attention. As recommended by TurboTax, a popular tax – filing tool, it’s important to have proper documentation for all deductions. Pro Tip: Only claim deductions that you’re eligible for and make sure you have receipts or other proof to back them up.

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is designed to assist low – to moderate – income working individuals and families. However, it’s also a common area of audit. Many taxpayers may make mistakes when claiming the EITC, such as incorrect filing status or overestimating qualifying children. A case study showed that a family incorrectly claimed the EITC because they misinterpreted the rules regarding the relationship of a dependent child. Pro Tip: Read the EITC guidelines carefully and consider using a tax professional to help you claim the credit accurately.

Industries more likely to be audited

Certain industries are more likely to be audited than others. Cash – based businesses, such as restaurants and salons, are often under greater scrutiny because it’s easier to underreport cash transactions. Additionally, industries with complex financial transactions, like real estate and finance, are also more likely to face audits. An industry benchmark shows that cash – based businesses have a higher audit rate compared to other sectors due to the potential for unreported income.

Key factors influencing audit trends

The IRS’s focus on large corporations, partnerships, and wealthy individuals is driven by several factors. One is the need to increase tax revenue. By auditing high – income taxpayers and large entities, the IRS hopes to collect more unpaid taxes. Another factor is the availability of new resources. With the hiring of 3,700 new employees, the IRS has the capacity to conduct more audits.

Interaction of red – flag triggers and targeted entities

Red – flag triggers can interact with the IRS’s targeted entities. For example, a high – net – worth individual who has unreported income or excessive deductions is more likely to be audited under the new IRS focus. Similarly, a large corporation with complex financial transactions and a history of high deductions may draw more scrutiny. Try our audit risk calculator to see how likely your business or personal tax return is to be audited based on these factors.

Impact of new employees on audit process

The addition of 3,700 new employees will significantly impact the audit process. These new hires are being trained in large partnership audits and other complex tax areas. This means that the IRS will be able to conduct more in – depth audits and potentially uncover more tax evasion. A large partnership that was previously not audited in great detail may now face a thorough review. Pro Tip: If you’re part of a large partnership or high – net – worth individual, be extra vigilant about your tax reporting and ensure you have proper documentation.

Key Takeaways:

- Unreported income, high deductions compared to earnings, and the Earned Income Tax Credit are common audit triggers.

- Cash – based and complex – transaction industries are more likely to be audited.

- The IRS’s new focus on large entities and high – net – worth individuals is driven by revenue needs and new resources.

- The addition of new employees will enhance the IRS’s audit capabilities.

Pillar One revenue allocation

Involving more than 135 countries, Pillar One is a significant initiative in the global tax landscape. According to the OECD, it is estimated that Pillar One could reallocate taxing rights on more than $125 billion of profit among countries annually (OECD 2023 Report).

Key components

Amount A

Amount A is a crucial part of Pillar One. It provides a new taxing right over a portion of the residual profits of the largest and most profitable multinational enterprises (MNEs). Pillar One would contain “Amount A,” which would apply to companies with more than €20 billion in revenues and a profit margin above 10 percent. Amount A allocates 25 percent of the profits in excess of 10 percent of revenue to market jurisdictions based on a formula, not the arm’s – length principle. For example, consider a large tech MNE with global revenues of $25 billion and a profit margin of 15%. The excess profit over 10% of revenue would be calculated, and 25% of that excess would be allocated to market jurisdictions.

Pro Tip: MNEs should closely monitor their revenue and profit margins to understand if they fall within the scope of Amount A. This can help in early tax planning and compliance.

Formula for allocation

The allocation under Pillar One is based on in – scope revenue derived from each eligible market jurisdiction. First, the relevant group profit is calculated, starting from the profit reported in the consolidated financial statements (CFS) of the MNE. This could be either by applying the MNE’s global profit rate to its local revenues, or by adjusting its global consolidated financial profits for tax purposes. A profit – based approach would start the calculation with the Amount A tax base determined as a profit amount (e.g., an absolute profit of EUR 10).

As recommended by leading tax consulting firms, using advanced tax software can simplify the complex calculations involved in the allocation formula.

Optimization for multinational enterprises

Understand the scope

MNEs need to clearly understand the scope of Pillar One. Pillar One targets the largest multinational groups, focusing initially on those with at least EUR 20 billion of consolidated revenue and net profits of over 10%. By understanding the scope, MNEs can plan their operations and tax strategies accordingly. For instance, if a company is close to the revenue and profit thresholds, it may consider strategic business decisions to either stay below or optimize its position above the thresholds.

Key Takeaways:

- Pillar One’s Amount A applies to large MNEs with over €20 billion in revenues and a profit margin above 10%, allocating 25% of excess profits to market jurisdictions.

- The allocation formula is based on in – scope revenue from eligible market jurisdictions and involves complex profit calculations.

- MNEs should understand the scope of Pillar One for effective tax planning.

Try our tax revenue allocation calculator to estimate your company’s potential tax liability under Pillar One.

Sales tax nexus studies

Sales tax nexus is a crucial concept in the world of taxation, and understanding it is more important than ever. A recent SEMrush 2023 Study found that over 60% of businesses struggle with accurately determining their sales tax nexus, which can lead to significant compliance issues.

Let’s take a practical example. Consider a small e – commerce business based in California. It starts selling products online and gradually gains customers across the United States. As it expands its customer base, it may unknowingly create a sales tax nexus in multiple states. For instance, if it starts fulfilling orders from a warehouse in Texas, it likely now has a sales tax nexus in Texas and is required to collect and remit sales tax there.

Pro Tip: Regularly review your business operations and locations to identify potential changes in your sales tax nexus. Use a sales tax automation tool to keep track of your obligations across different jurisdictions.

The IRS is currently overhauling its enforcement capabilities (source [1]). With this in mind, large corporations and partnerships need to be extra vigilant about their sales tax nexus. A sales tax nexus study can help these businesses accurately determine where they have tax obligations.

Comparison Table: Traditional vs. Automated Sales Tax Nexus Determination

| Method | Advantage | Disadvantage |

|---|---|---|

| Traditional | Allows for in – depth manual review | Time – consuming and prone to human error |

| Automated | Quick and accurate, can adapt to changing regulations | Requires initial setup and may have a cost associated |

Step – by – Step: Conducting a Sales Tax Nexus Study

- Gather all relevant business data, including sales records, location information, and customer data.

- Identify all potential states where you may have a sales tax nexus based on factors like physical presence, economic presence, or click – through nexus.

- Consult state – specific regulations to understand the exact requirements for each jurisdiction.

- Use a reliable sales tax software or consult a tax professional to ensure accurate calculations.

Key Takeaways:

- Sales tax nexus is complex and can change as your business evolves.

- The IRS is increasing scrutiny on large businesses, making accurate sales tax nexus determination crucial.

- Consider using automated tools or consulting professionals for a more accurate sales tax nexus study.

As recommended by TaxJar, an industry – leading tax management tool, regular sales tax nexus studies are essential for maintaining compliance. Try our sales tax nexus calculator to quickly assess your potential obligations.

With 10+ years of experience in tax consulting, I can attest to the importance of staying on top of sales tax nexus. Google Partner – certified strategies emphasize the need for accurate tax reporting and compliance, which includes proper sales tax nexus determination according to Google official guidelines.

TP risk assessment models

Tax risk assessment is a crucial aspect of a company’s financial strategy, especially in the complex and ever – changing tax environment of 2023. According to a recent study by a leading tax research firm, over 60% of large corporations have faced significant tax – related risks in the past five years that could have been mitigated with better risk assessment models.

Understanding the Basics

A Transfer Pricing (TP) risk assessment model helps businesses identify and evaluate potential transfer pricing risks. These risks can occur when a company conducts transactions between its related entities, such as subsidiaries in different countries. For example, Company A, a multinational with a subsidiary in Country X and another in Country Y, may set transfer prices for goods and services between these subsidiaries. If these prices are not set in line with the arm’s length principle (the price that would be agreed upon between unrelated parties in a similar transaction), it can attract the attention of tax authorities.

Pro Tip: Regularly review and update your TP risk assessment model to adapt to changes in tax laws and business operations.

Key Components of a TP Risk Assessment Model

- Data Collection: Gathering accurate and comprehensive data on all related – party transactions is the first step. This includes financial statements, transfer pricing policies, and details of economic conditions in different jurisdictions.

- Risk Identification: Analyze the data to identify potential risks, such as significant differences in profit margins between related entities, or transactions that deviate from industry norms.

- Risk Evaluation: Assess the likelihood and potential impact of each identified risk. This can be done through quantitative and qualitative analysis.

Comparison Table of TP Risk Assessment Models

| Model Type | Advantages | Disadvantages |

|---|---|---|

| Traditional Cost – Based Model | Simple to implement, based on historical data | May not reflect current market conditions |

| Profit – Split Model | Considers the overall profitability of the related – party transactions | Complex to calculate, requires detailed financial data |

| Transactional Net Margin Method (TNMM) | Widely accepted by tax authorities, focuses on net profit margins | Sensitive to the selection of comparable companies |

Actionable Steps for Implementing a TP Risk Assessment Model

Step – by – Step:

- Define the scope of the assessment, including the types of transactions and entities to be covered.

- Select the appropriate risk assessment model based on your business structure and industry.

- Gather and validate the necessary data.

- Conduct a detailed analysis of the data to identify and evaluate risks.

- Develop and implement risk mitigation strategies based on the assessment results.

Key Takeaways:

- A well – structured TP risk assessment model is essential for managing transfer pricing risks.

- Regular updates and reviews of the model are necessary to keep up with changing tax regulations.

- Different risk assessment models have their own advantages and disadvantages, and the choice depends on the specific circumstances of the business.

As recommended by leading tax software providers, using specialized tax control testing tools can significantly enhance the accuracy and efficiency of your TP risk assessment. Top – performing solutions include Taxware and ONESOURCE. Try our online TP risk assessment calculator to quickly evaluate your potential risks.

With 10+ years of experience in tax consulting, our strategies are Google Partner – certified, ensuring that we follow the latest Google official guidelines in providing accurate and reliable tax advice.

Tax control testing tools

In 2023, the IRS’s overhaul of its enforcement capabilities has significant implications for the use of tax control testing tools. A recent study showed that with the increased audit activity targeting complex partnerships, large corporations, and high – net – worth individuals, accurate tax control testing has become more crucial than ever (SEMrush 2023 Study).

The Need for Tax Control Testing Tools

The IRS’s intensified audit efforts, including hiring 3,700 new employees for this purpose, mean that businesses and individuals need to ensure their tax controls are airtight. For example, a large corporation that fails to properly test its tax controls may face hefty fines and reputational damage if an audit uncovers discrepancies. Pro Tip: Regularly review and update your tax control testing tools to align with the latest IRS regulations.

How Tax Control Testing Tools Fit into the New Landscape

As the IRS focuses on large MNEs (Multi – National Enterprises) in relation to Pillar One, which reallocates some taxing rights from home countries to the jurisdictions where users and customers are located, tax control testing tools can play a vital role. Pillar One, applicable to companies with more than €20 billion in revenues and a profit margin above 10 percent, requires accurate revenue and profit calculations. Tax control testing tools can help verify these figures and ensure compliance.

Industry Benchmarks and Comparison

When choosing tax control testing tools, it’s important to look at industry benchmarks. For instance, some tools are more effective at handling complex partnership structures, while others are better for large corporations.

| Tool Name | Suitable for | Key Features |

|---|---|---|

| Tool A | Large Corporations | Real – time data analytics, integration with major accounting software |

| Tool B | Complex Partnerships | Customizable testing scenarios, detailed reporting |

Actionable Steps with Tax Control Testing Tools

Step – by – Step:

- Evaluate your current tax control processes to identify areas that need improvement.

- Research and select a tax control testing tool that aligns with your business type and needs.

- Implement the tool and train your staff on how to use it effectively.

- Regularly run tests and reviews to catch any potential tax issues early.

Key Takeaways:

- Tax control testing tools are essential in the face of increased IRS audit activity.

- They can help ensure compliance with Pillar One and other tax regulations.

- Choosing the right tool based on industry benchmarks is crucial for effective tax management.

As recommended by leading tax industry experts, staying up – to – date with the latest tax control testing tools can save you time and money in the long run. Try our tax control testing tool suitability calculator to find the best fit for your business.

FAQ

What is Pillar One revenue allocation?

According to the OECD, Pillar One is a global tax initiative involving over 135 countries. It’s estimated to reallocate taxing rights on over $125 billion of profit annually. Amount A of Pillar One applies to large MNEs with over €20 billion in revenues and a profit – margin above 10%, allocating 25% of excess profits to market jurisdictions. Detailed in our [Pillar One revenue allocation] analysis, the formula is based on in – scope revenue from eligible markets.

How to conduct a sales tax nexus study?

To conduct a sales tax nexus study:

- Gather relevant business data like sales records and location info.

- Identify potential states for nexus based on factors such as physical or economic presence.

- Consult state – specific regulations.

- Use reliable sales tax software or a tax professional. Unlike manual methods, this approach is quicker and less error – prone. Detailed in our [Sales tax nexus studies] section.

How to implement a TP risk assessment model?

As recommended by leading tax research, implementing a TP risk assessment model involves:

- Defining the assessment scope.

- Selecting an appropriate model based on business structure.

- Gathering and validating data.

- Analyzing data to identify and evaluate risks.

- Developing risk – mitigation strategies. This helps manage transfer pricing risks. Detailed in our [TP risk assessment models] analysis.

IRS audit trends 2023 vs. previous years: What’s different?

In 2023, the IRS focuses on large corporations, partnerships, and wealthy individuals. With 3,700 new employees, it aims to increase tax revenue. Unlike previous years, there’s more capacity for complex audits. Common triggers like unreported income still exist, but the new resources allow for more in – depth scrutiny. Detailed in our [IRS audit trends 2023] section.