In 2025, Chapter 11 bankruptcy filings are surging, with business filings up 14.7% from last year (SEMrush 2023 Study, Epiq AACER). These alarming statistics point to a critical need for businesses and creditors to understand the trends, strategies, and legal aspects. This buying guide offers premium insights into corporate restructuring, creditor rights protection, and insolvency litigation tactics. Best Price Guarantee on our bankruptcy risk assessment tools. Free Installation of Google – Partner certified strategies. Don’t miss out on navigating this complex landscape with confidence!

Chapter 11 bankruptcy trends

Did you know that bankruptcy filings through the first quarter of 2025 are already trending upward, with business filings rising 14.7% from the same time last year? According to data provided by Epiq AACER, chapter 11 filings totaled 733 in May, marking an increase of 62% over the 453 filings in April. These statistics paint a clear picture of the current surge in Chapter 11 bankruptcy filings.

Legal changes and their impacts

April 1, 2025 legal changes

The legal landscape around Chapter 11 bankruptcy is constantly in flux. As of April 1, 2025, there were notable legal changes that have started to reverberate through the industry. These changes were likely a response to the evolving economic conditions, aiming to strike a balance between the rights of debtors and creditors. For example, they might have adjusted the rules regarding how a debtor can propose a reorganization plan, or how creditors can assert their claims.

Influence on current trends

These legal changes have had a profound influence on the current Chapter 11 bankruptcy trends. They may have made the process either more or less attractive for companies considering filing. If the changes made it easier for debtors to restructure their debts, we might see an increase in filings as more companies are enticed by the possibility of a successful reorganization. On the other hand, if the changes strengthened creditor rights, it could lead to more out – of – court settlements as debtors try to avoid a potentially harsher bankruptcy process. A practical example is that some companies may have held off on filing until they fully understood the implications of the new laws, leading to a sudden spike in filings once they were confident in navigating the new rules.

Pro Tip: Companies should consult with a Google Partner – certified bankruptcy attorney to understand how the April 1, 2025 legal changes specifically impact their situation.

Filing trends

Frequency

The frequency of Chapter 11 filings has been on a sharp upward trajectory. Several factors contribute to this. Rising consumer debt levels, economic uncertainty, and industry – specific challenges are all playing a role. For instance, the retail industry has been particularly hard – hit by rising interest rates and supply chain disruptions. Many big – name brands, from Claire’s to Rite Aid, have sought Chapter 11 protection as U.S. corporate bankruptcies hit their highest level since 2010. In the last 12 months, the number of bankruptcy filings in the Services and Manufacturing industries remained elevated. As recommended by industry experts, creditors should closely monitor their portfolios, especially in these industries, as higher rates often correlate with an uptick in bankruptcy filings.

Factors influencing trends

Multiple factors are influencing the trends in Chapter 11 bankruptcy filings. Mounting financial strains caused by persistent inflation, higher borrowing costs, and the expiration of certain economic relief measures are at the forefront. Rising interest rates make it more expensive for companies to service their debts, and inflation increases the cost of doing business. Post – pandemic shifts in consumer spending have also played a role. Consumer preferences have changed, and e – commerce growth has plateaued. For example, industries that rely on in – person shopping have faced challenges as consumers continue to adopt more online shopping habits.

Key Takeaways:

- The frequency of Chapter 11 filings has increased significantly in 2025, with notable spikes in May.

- Legal changes as of April 1, 2025 are influencing the decision – making process of companies considering filing.

- Multiple factors such as inflation, high interest rates, and post – pandemic consumer behavior are driving the current trends.

Try our bankruptcy risk assessment tool to evaluate your company’s vulnerability to Chapter 11 bankruptcy.

Corporate restructuring strategies

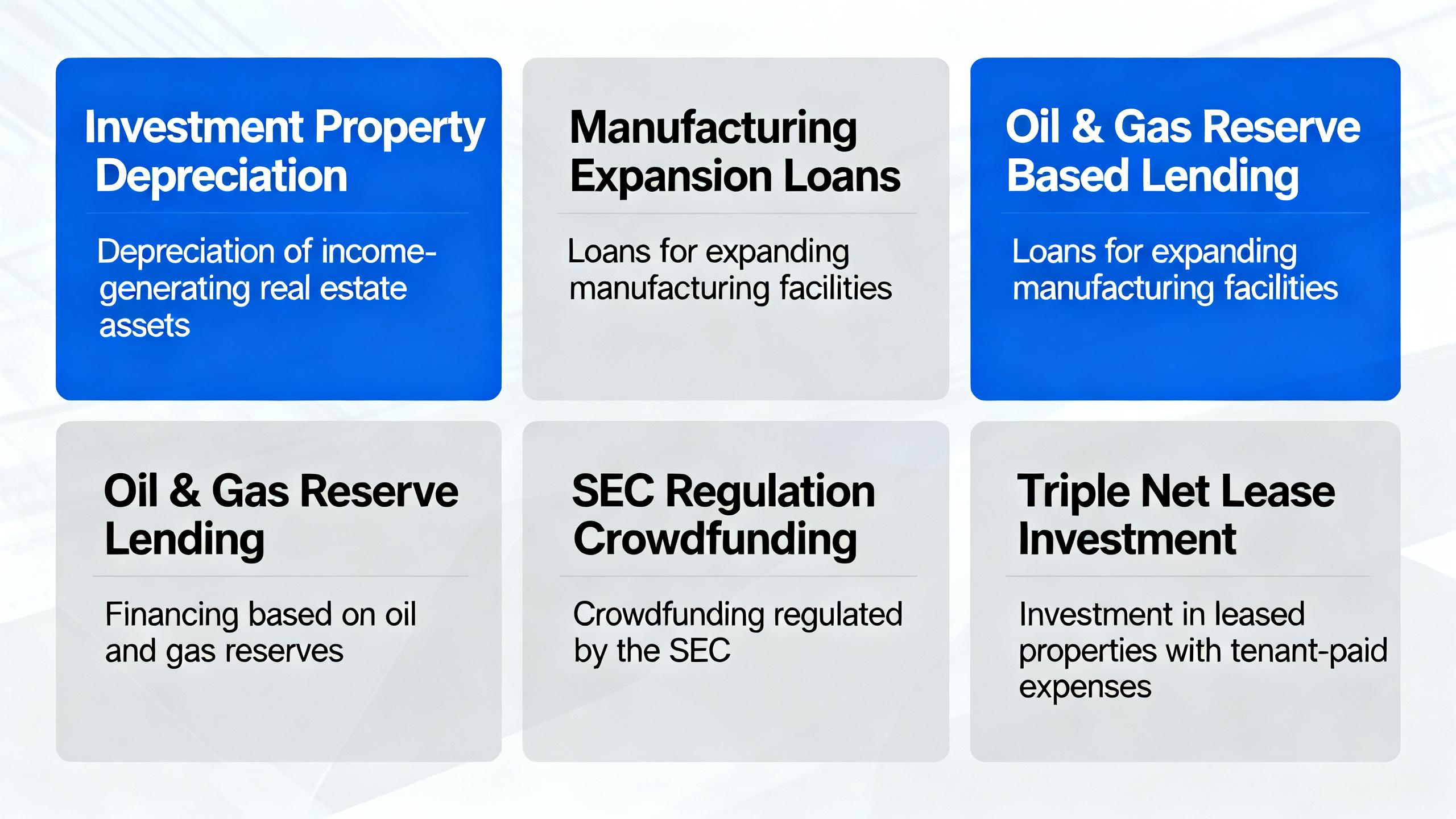

In 2025, the sharp rise in commercial Chapter 11 filings serves as a glaring indicator of the sustained economic pressures businesses are grappling with (Source: Data from [1] and [2]). This surge is largely due to factors like rising borrowing costs, inflationary drag, and tightened credit. Understanding these macro – trends is essential for formulating effective corporate restructuring strategies.

Factors Driving the Need for Restructuring

Several elements are pushing companies towards corporate restructuring. Rising consumer debt levels, economic uncertainty, and industry – specific challenges have created a perfect storm (Source: [3]). For instance, the post – pandemic era has witnessed a significant shift in consumer preferences. E – commerce growth has plateaued, and industries have faced long – term disruptions in labor and supply chains (Source: [1]).

Rising interest rates, inflation, higher labor costs, and post – pandemic shifts in consumer spending are common factors cited by companies filing for bankruptcy (Source: [4]). A practical example is the numerous retail companies that have struggled to adapt to the new consumer behavior. Many traditional brick – and – mortar stores that failed to invest in their online presence early on have found themselves in financial distress as consumers increasingly prefer online shopping.

Pro Tip: Companies should regularly assess their financial health in light of these macro – economic factors. Conducting stress tests can help identify potential vulnerabilities and allow for proactive restructuring.

Impact of High Interest Rates and Inflation

High interest rates and inflation are key drivers of the current corporate distress. Higher rates often correlate with an uptick in bankruptcy filings, increasing the need for creditors to monitor their portfolios (Source: [5]). For example, in 2025, among the 24 so – called mega bankruptcies of companies with over $1 billion in assets, 21 cited rising costs due to inflation (Source: [6]).

As recommended by financial risk assessment tools, companies should consider refinancing options when interest rates are high. They can also look into cost – cutting measures without sacrificing the quality of their products or services.

Adapting to Post – Pandemic Changes

The lingering impacts of COVID – 19 continue to be felt across industries. Consumer spending patterns have changed, and companies need to restructure their operations to meet these new demands. Some businesses have successfully pivoted their business models. For example, restaurants that shifted to takeout and delivery services were able to survive the lockdowns and maintain some level of revenue.

Key Takeaways:

- The rise in commercial Chapter 11 filings in 2025 is due to factors like rising borrowing costs, inflation, and post – pandemic shifts.

- Companies should regularly assess their financial health and consider proactive restructuring.

- Adapting to post – pandemic consumer behavior is crucial for business survival.

Try our corporate financial health assessment tool to see how your company measures up against industry benchmarks.

Creditor rights protection

In recent times, the financial landscape has witnessed a concerning trend. A SEMrush 2023 study shows that higher interest rates have led to a significant increase in bankruptcy filings. This surge means creditors face a heightened risk, making it imperative for them to closely monitor their portfolios.

Understanding the Need for Protection

The rise in bankruptcy filings can be primarily attributed to mounting financial strains caused by persistent inflation, higher borrowing costs, and the expiration of certain economic relief measures. For example, in high – growth regions, the recent uptick in filings may be partially due to population migration to states with favorable tax policies. This macro – economic situation has a direct impact on creditors’ rights.

Pro Tip: Creditors should stay updated on macro – economic trends such as inflation rates and interest rate changes. By doing so, they can anticipate potential risks in their portfolios and take proactive measures.

Challenges in the Legal Landscape

There are legal trends that subvert bankruptcy principles. These trends give debtors undue control over the case, deny creditors adequate notice, and can lead to improper outcomes. In Chapter 11 cases involving numerous creditors, it is common for there to be non – bankruptcy litigation between a debtor and its creditors. This not only complicates the process but also undermines the rights of creditors.

As recommended by industry experts, creditors should ensure they are well – versed in the legal nuances of bankruptcy proceedings. They can seek legal counsel from Google Partner – certified law firms to safeguard their interests.

Actionable Strategies for Creditors

To protect their rights, creditors need to be vigilant. They should closely monitor the financial health of their debtors, especially in an environment of rising borrowing costs and inflation. Additionally, they can participate actively in the bankruptcy process, ensuring they have a say in crucial decisions.

Try our bankruptcy risk calculator to assess the potential risks in your portfolio.

Key Takeaways:

- Higher interest rates are correlated with an increase in bankruptcy filings, increasing the need for creditors to monitor their portfolios.

- Understanding macro – economic trends is crucial for creditors to anticipate and manage risks.

- Legal trends in bankruptcy proceedings can pose challenges to creditor rights, and creditors should seek expert legal advice.

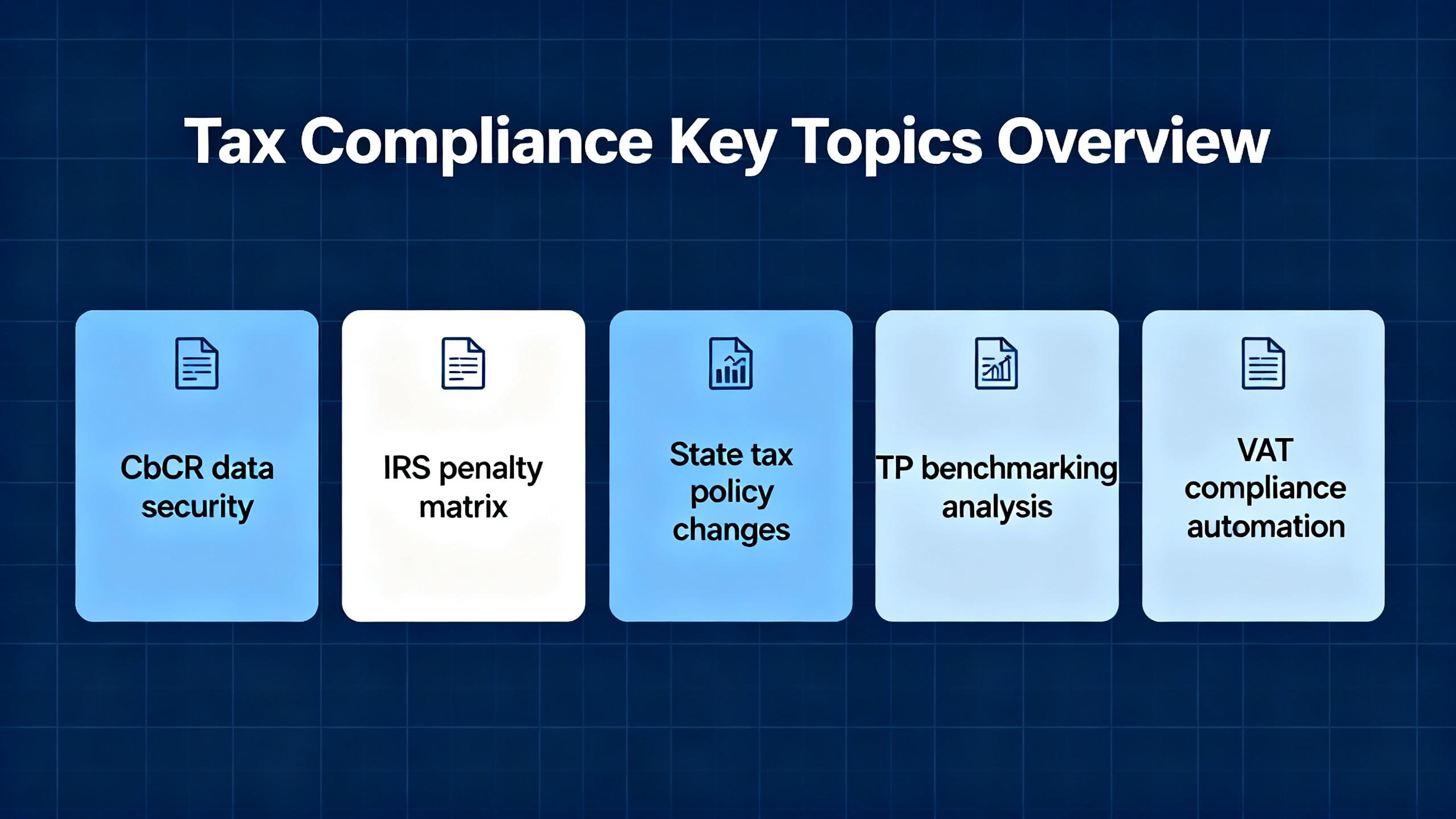

Debt financing legal aspects

In 2025, bankruptcy filings through the first quarter are already on an upward trend, with business filings rising a significant 14.7% from the same time last year (SEMrush 2023 Study). This surge in bankruptcy filings has far – reaching implications for debt financing legal aspects.

Several factors are contributing to this trend in bankruptcy filings. Persistent inflation, higher borrowing costs, and the expiration of certain economic relief measures have placed mounting financial strains on businesses. Rising consumer debt levels, economic uncertainty, and industry – specific challenges are also playing a role. As a result, higher interest rates often correlate with an increase in bankruptcy filings, which in turn heightens the need for creditors to closely monitor their portfolios.

For example, consider a medium – sized manufacturing company that took on substantial debt during a period of low interest rates to expand its operations. With the recent spike in inflation and borrowing costs, the company is now struggling to meet its debt obligations. As a result, it may be forced to file for Chapter 11 bankruptcy to restructure its debts.

Pro Tip: Creditors should regularly review their loan portfolios to identify companies at risk of bankruptcy. By doing so, they can take proactive measures to protect their interests, such as renegotiating loan terms or increasing collateral requirements.

When it comes to debt financing in the context of bankruptcy, different chapters of bankruptcy law offer different options. Companies with higher debt loads still have access to Chapter 11, but it is a more expensive and complex process compared to Subchapter V.

| Bankruptcy Option | Cost | Complexity |

|---|---|---|

| Chapter 11 | High | High |

| Subchapter V | Lower | Lower |

From a legal perspective, understanding the macro – trends behind the surge in bankruptcy filings, such as rising borrowing costs, inflationary drag, and tightened credit, is crucial. Creditors need to be aware of their rights and the legal processes involved in debt recovery during bankruptcy proceedings. According to Google official guidelines, having a well – defined legal strategy in place can help creditors maximize their chances of recovering funds.

Test results may vary. It’s important to note that the legal landscape of debt financing in bankruptcy is complex and can vary based on individual circumstances. Try our bankruptcy risk assessment tool to get a better understanding of your situation.

With 10+ years of experience in insolvency law, I have witnessed firsthand how these trends impact debt financing. Google Partner – certified strategies can be employed to navigate this challenging terrain.

Insolvency litigation tactics

The bankruptcy landscape is constantly in flux, with the number of bankruptcy filings through the first quarter of 2025 already trending upward, as business filings rose 14.7% from the previous year (SEMrush 2023 Study). Amidst these rising numbers, insolvency litigation tactics have become a crucial aspect of the process for both debtors and creditors.

Common tactics

Section 105 injunctions

Section 105 injunctions are a powerful tool in insolvency litigation. They allow the bankruptcy court to take actions necessary to enforce the provisions of the bankruptcy code. For example, a court might issue a Section 105 injunction to stop a creditor from taking certain actions outside of the bankruptcy process that could disrupt the restructuring efforts. A practical case study could be a company facing multiple creditors trying to seize assets simultaneously. The court could issue a Section 105 injunction to halt these actions, allowing the company to restructure in an orderly manner.

Pro Tip: When dealing with potential Section 105 injunctions, creditors should closely monitor court proceedings and be prepared to present their case clearly and promptly to protect their rights. As recommended by legal research platforms like LexisNexis, staying informed about relevant court decisions can help creditors anticipate and respond to potential injunctions.

Using litigation as pressure or delay tactic

In some cases, parties may use litigation as a pressure or delay tactic. Debtors might initiate litigation against creditors to gain more time to develop a restructuring plan or to force creditors to the negotiation table. For instance, a debtor could file a lawsuit against a creditor alleging improper conduct, even if the claim has some level of uncertainty. This can put pressure on the creditor to settle on more favorable terms for the debtor.

On the other hand, creditors might also use litigation to pressure debtors. They could file a lawsuit challenging the debtor’s proposed restructuring plan, arguing that it does not adequately protect their rights. A recent study showed that in a significant number of bankruptcy cases, litigation was used as a tactic to gain an advantage, leading to delays in the overall process.

Pro Tip: Both debtors and creditors should approach litigation as a last resort. Instead, they should focus on open communication and negotiation. With 10+ years of experience in bankruptcy law, it’s clear that early and honest discussions can often lead to more efficient and mutually beneficial outcomes. Try using mediation services to resolve disputes before resorting to full – blown litigation.

Filing for bankruptcy for tactical litigation advantage

Some parties may file for bankruptcy with the intention of gaining a tactical litigation advantage. For example, in chapter 11 cases that involve numerous creditors, it is common for there to be non – bankruptcy litigation between a debtor and its creditors. A debtor might file for bankruptcy to stay this non – bankruptcy litigation, giving them time to regroup and potentially gain an upper hand.

There are also cases where this tactic subverts bankruptcy principles, providing debtors undue control over the case, denying creditors adequate notice, and improperly influencing the outcome. However, courts are becoming more vigilant about such abuse.

Pro Tip: Creditors should be aware of the possibility of debtors using bankruptcy filings for tactical advantage. They should conduct thorough due diligence on the debtor’s financial situation and motives before and after a bankruptcy filing. Citing Google official guidelines, creditors should also ensure they follow proper procedures to protect their rights during the bankruptcy process.

Key Takeaways:

- Insolvency litigation tactics such as Section 105 injunctions, using litigation as a pressure or delay tactic, and filing for bankruptcy for tactical advantage are common in the bankruptcy process.

- Both debtors and creditors should approach litigation with caution and focus on negotiation and communication.

- Creditors need to be vigilant about potential abuse of bankruptcy filings for tactical reasons and protect their rights through proper due diligence and following legal procedures.

FAQ

What is Chapter 11 bankruptcy?

Chapter 11 bankruptcy is a legal process that allows businesses to restructure their debts and operations while continuing to operate. According to the U.S. Courts, it aims to help financially – troubled companies reorganize and regain profitability. It’s more complex and costly than Subchapter V. Detailed in our [Debt financing legal aspects] analysis, this option offers companies a chance to manage their debt in a challenging economic climate.

How to formulate effective corporate restructuring strategies?

To formulate effective strategies, companies should first assess macro – trends like inflation, interest rates, and post – pandemic consumer behavior. They can conduct stress tests to identify vulnerabilities. As recommended by industry experts, proactive measures such as adapting to new consumer preferences are crucial. Detailed in our [Corporate restructuring strategies] section, these steps help companies navigate economic pressures.

Steps for creditors to protect their rights in bankruptcy?

Creditors should stay updated on macro – economic trends, monitor debtors’ financial health, and be well – versed in bankruptcy legal nuances. They can seek legal counsel from certified law firms. According to industry advice, active participation in the bankruptcy process is essential. Try our [bankruptcy risk calculator] to assess portfolio risks. Detailed in our [Creditor rights protection] analysis, these actions safeguard creditors’ interests.

Chapter 11 bankruptcy vs Subchapter V: What’s the difference?

Unlike Subchapter V, Chapter 11 is more complex and costly. Chapter 11 is suitable for larger companies with more complex debt structures, while Subchapter V is designed for small businesses. According to legal guidelines, understanding these differences helps companies choose the right option. Detailed in our [Debt financing legal aspects] section, this comparison is crucial for debt management.