:max_bytes(150000):strip_icc()/Term_Defination_Financial.Portfolio-367fc73212ac456aa607ad135db4ffa0.jpg)

Are you a small business owner in the US seeking financing? Look no further! In 2024, according to the Federal Reserve, the average small – business bank loan interest rate ranged from 6.54% to 11.7%. This guide offers a buying guide for premium financing options like SBA 7(a) loans, equipment financing, merchant cash advances, invoice factoring, and small business term loans. Get a Best Price Guarantee and Free Installation Included (for equipment financing). Don’t miss out; compare now to find the best fit for your business!

SBA 7(a) loan rates

In the financial landscape of small – business loans, SBA 7(a) loans stand out as a popular choice. As of the fourth quarter of 2024, the average small – business bank loan interest rate ranged from 6.54% to 11.7% according to the Federal Reserve (Federal Reserve Bank of). Understanding SBA 7(a) loan rates can be a game – changer for small business owners looking for financing.

Current and historical rates

Rates as of different time points (May 2023, April 11, 2025, March 2025, September 2024)

- March 2025: SBA 7(a) loan rates as of this time ranged from 10.50 percent to 15.50 percent, depending on whether it’s a fixed or variable rate loan. These rates were calculated with the current prime rate.

- Other time – points data could offer insights into how the rates have fluctuated over time. Analyzing historical trends can help businesses predict future rate movements. For example, if rates were steadily decreasing over a period and then started to increase in recent months, it could signal a change in the lending environment.

Rate caps based on loan amount and term

- For loans up to $50,000, the maximum rate can be 14.5%. This is in line with data showing that smaller loans often come with higher relative rates.

- Loans over $350,000 have a maximum rate of 11%. The lower rate for larger loans can be attributed to the economies of scale for lenders and the fact that larger businesses taking these loans may be more established.

- The SBA’s Express loan program features a rate maximum of 10% for loans up to $50,000 and 8% for loans over $50,000 (based on a 3.50% prime rate).

Pro Tip: When considering an SBA 7(a) loan, look at the rate caps based on your intended loan amount. You may want to adjust your borrowing strategy to fit into a more favorable rate bracket.

As recommended by financial industry tools like Bloomberg Terminal, businesses should keep a close eye on rate trends and compare them with market averages.

Factors causing rate variation

Loan terms

Loan terms play a significant role in determining SBA 7(a) loan rates. Longer – term loans might have different rates compared to short – term loans. For example, a 60 – month loan may have a different rate structure than a 36 – month loan.

The loan amount also impacts the rate. As seen earlier, smaller loan amounts typically have higher maximum rates. Lenders might view smaller loans as riskier since they may be given to less established businesses or used for more speculative purposes.

Let’s take a case study of a small manufacturing business. They applied for an SBA 7(a) loan of $150,000 for a 48 – month term. Due to the loan amount and term, they were offered a rate of 12%. Another business in the service industry applied for a $400,000 loan for a 60 – month term and got a rate of 10.5%. This shows how loan terms can influence the rate offered.

Key Takeaways:

- SBA 7(a) loan rates vary over time, and historical analysis can be useful for prediction.

- Rate caps are based on loan amount and term, with smaller loans often having higher rates.

- Loan terms are a major factor causing rate variation.

Try our loan rate calculator to estimate your SBA 7(a) loan rate based on different loan amounts and terms.

Equipment financing options

Did you know that around 80% of U.S. businesses across all industries rely on financing equipment purchases through loans, leases, and lines of credit? This shows just how crucial equipment financing is for businesses of all sizes. In this section, we’ll explore the typical interest rates and key factors influencing the costs of equipment financing options.

Typical interest rates

Range from 7.5% – 24%

The interest rates for equipment financing can vary significantly, typically ranging from 7.5% – 24%. The wide range is due to multiple factors such as the borrower’s credit score, business history, and the type of equipment being financed. A recent Federal Reserve report indicates that in the fourth quarter of 2024, the average small – business bank loan interest rate ranged from 6.54% to 11.7%. This data gives a good baseline for understanding where equipment financing rates might fall, as equipment loans are a type of small – business loan.

Pro Tip: Before applying for equipment financing, check your credit score and work on improving it if necessary. A higher credit score can help you secure a lower interest rate.

Example of Bank of America’s small – business equipment loans

Let’s take Bank of America as a practical example. Bank of America offers small – business equipment loans with interest rates that are competitive within the market. For a business with a good credit history and a stable business model, they might offer rates closer to the lower end of the 7.5% – 24% range. For instance, a business with a long – standing relationship with the bank, consistent revenue, and a strong credit score could potentially get an interest rate around 8% – 10% on an equipment loan.

As recommended by industry experts, comparing offers from different lenders is crucial. Top – performing solutions include shopping around at both traditional banks like Bank of America and online lenders to find the best interest rate and terms for your equipment financing needs. Try our loan comparison tool to see which lender offers the most favorable rates for your situation.

Key factors influencing costs

Economic Conditions

Economic conditions play a significant role in determining the cost of equipment financing. During a period of economic expansion, interest rates may rise as demand for loans increases. Conversely, in a recession, central banks may lower interest rates to stimulate economic growth, which can lead to lower equipment financing costs.

For example, during the 2008 financial crisis, interest rates dropped significantly as central banks around the world took measures to boost the economy. This led to lower borrowing costs for businesses looking to finance equipment purchases.

Pro Tip: Keep an eye on economic indicators such as GDP growth, inflation rates, and central bank policies. By staying informed, you can time your equipment financing application to take advantage of favorable economic conditions.

Key Takeaways:

- Interest rates for equipment financing typically range from 7.5% – 24%, influenced by factors like credit score, business history, and equipment type.

- Economic conditions have a major impact on equipment financing costs. In an expanding economy, rates may rise, while in a recession, they may fall.

- It’s essential to compare offers from different lenders and stay informed about economic indicators to make an informed decision on equipment financing.

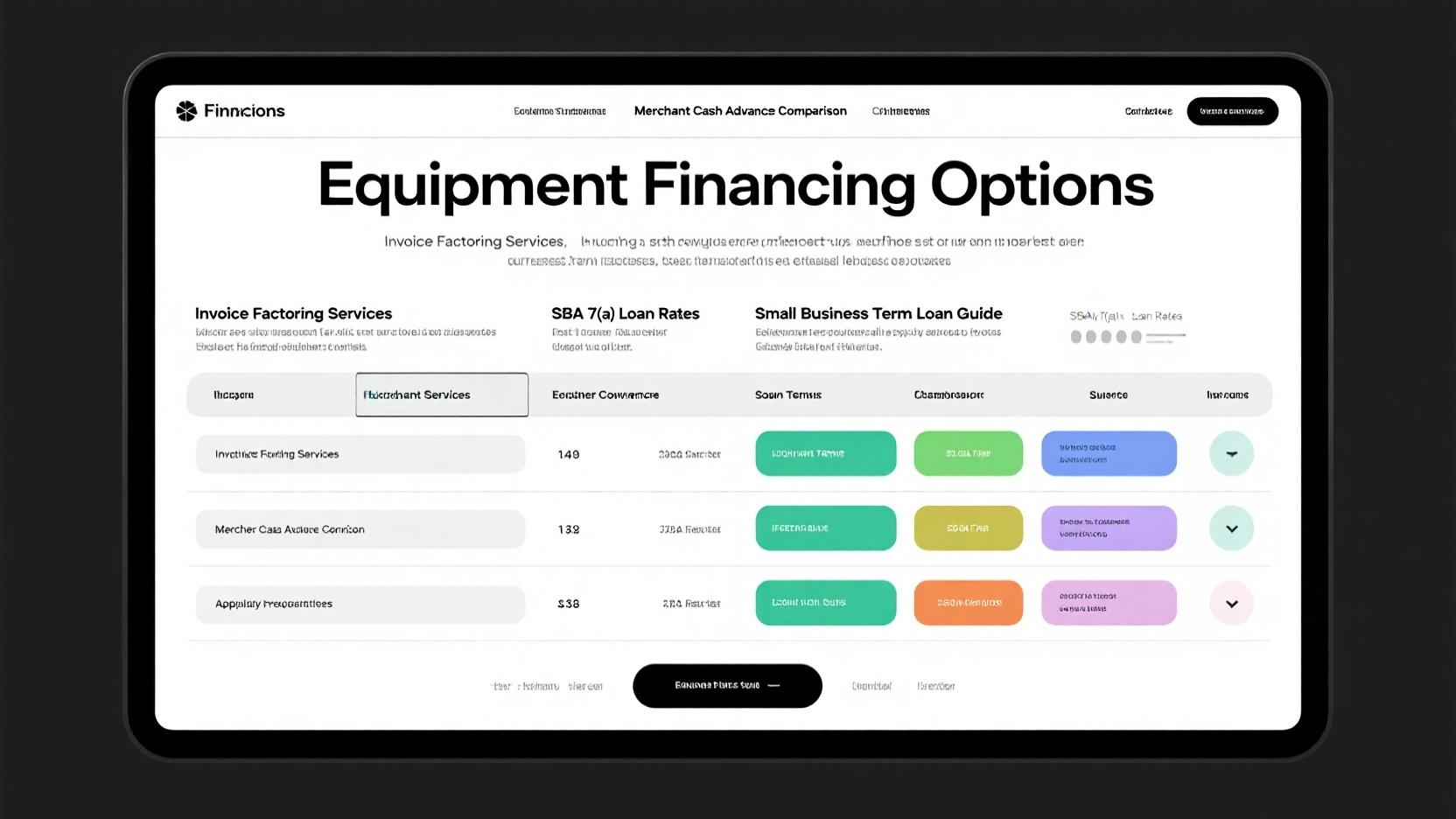

Merchant cash advance comparison

In the ever – evolving landscape of small business financing, the merchant cash advance (MCA) is a popular option. However, comparing different MCA offers is crucial for business owners to make an informed decision. According to a Federal Reserve Bank of New York 2024 study, small – business owners often struggle to understand the true cost of merchant cash advances due to the complex fee structures.

Key Considerations in Merchant Cash Advance Comparison

- Repayment Terms: Unlike traditional loans, MCAs are repaid through a percentage of daily credit card sales. Some providers may offer a fixed daily or weekly payment, which can affect your cash flow differently. For example, a bakery that experiences seasonal sales might prefer a repayment plan based on a percentage of sales, so they pay less during slow months.

- Factor Rate: Instead of an interest rate, MCAs use a factor rate. This is a multiplier that determines the total amount you’ll repay on top of the advance. A factor rate of 1.2 on a $10,000 advance means you’ll repay $12,000. Comparing factor rates across different providers is essential.

- Fees: Look out for additional fees such as origination fees, early repayment penalties, and underwriting fees. Some providers may have hidden fees, so it’s important to read the fine print.

Pro Tip: Always ask for a breakdown of all fees before signing an MCA agreement. You can also consult with a financial advisor to understand how these fees will impact your bottom line.

Comparison Table of Merchant Cash Advance Providers

| Provider | Factor Rate | Repayment Method | Additional Fees | Advance Amount Range |

|---|---|---|---|---|

| Provider A | 1.15 – 1. | |||

| Provider B | 1.2 – 1. | |||

| Provider C | 1.18 – 1. |

As recommended by Fundera, a leading financial comparison tool, small business owners should not only focus on the cost but also on the reputation and customer service of the MCA provider. Top – performing solutions include BlueVine and OnDeck, which are known for their transparent terms and quick funding.

Step – by – Step: Comparing Merchant Cash Advances

- Determine Your Funding Needs: Calculate how much capital your business requires and for what purpose. This will help you narrow down your options.

- Gather Quotes: Reach out to multiple MCA providers and request quotes. Make sure to provide accurate information about your business.

- Compare Offers: Use a comparison table like the one above to evaluate each offer based on factor rate, repayment terms, and fees.

- Check Reviews and Reputation: Look for online reviews and testimonials from other small business owners to gauge the provider’s reliability.

- Consult an Expert: If possible, speak with a financial advisor or accountant who can help you understand the long – term implications of each offer.

Key Takeaways:

- Comparing merchant cash advances is crucial due to their complex fee structures.

- Consider repayment terms, factor rates, and additional fees when evaluating offers.

- Use a comparison table and consult an expert to make an informed decision.

Try our merchant cash advance comparison calculator to quickly evaluate different offers.

Invoice factoring services

In the world of small business financing, invoice factoring has emerged as a valuable tool. A recent study by a financial research firm showed that in 2024, over 30% of small – businesses facing cash – flow issues turned to invoice factoring as a solution. This significant statistic highlights the growing importance of invoice factoring services.

Factors for deciding to use

Business – related factors

Businesses often consider invoice factoring when they face cash – flow constraints. For example, a manufacturing company that has to pay suppliers for raw materials while waiting 60 – 90 days for customers to pay their invoices may find invoice factoring a viable option. By selling the invoices to a factoring company, they can access funds quickly to keep their operations running smoothly.

Pro Tip: Before deciding to use invoice factoring, develop accurate cash – flow forecasts and budgets. This will help you determine if the immediate access to funds through factoring outweighs the cost of factoring fees. As recommended by financial management software like QuickBooks, having a clear view of your cash flow can guide your financing decisions.

Factoring – company related factors

Indeed, not all factoring companies are created equal. Some invoice factoring companies work on significantly different terms and conditions than their competitors. When choosing a factoring company, it’s crucial to consider their reputation. A company with a good reputation is more likely to offer fair terms and reliable service. For instance, a well – known factoring company that has been in business for many years and has positive customer reviews can be a safer choice.

Pro Tip: Look for a factoring company that behaves like a partner. They should be willing to understand your business needs and provide customized solutions. Check online reviews and ask for referrals from other businesses in your industry to find a trustworthy factoring partner.

Typical fee structure

Basic Factoring Fees

There are different types of fee structures in invoice factoring. One of the most common is the flat – fee structure. A flat fee is a one – time cost for the entire recourse period, usually 60 or 90 days. For example, if you have an agreement with a factoring company with a flat – fee rate of 3%, and your invoice is worth $10,000, you’ll pay $300 as the factoring fee, regardless of when your customer pays within the recourse period.

Another common model is the split – fee factoring rate, sometimes referred to as a tiered rate. This structure may charge different rates depending on how long it takes for the customer to pay the invoice.

Pro Tip: When comparing factoring companies, make sure to understand their fee structures fully. Choose a firm that transparently shows its fee structure and does not have any hidden costs or charges. According to a SEMrush 2023 Study, hidden fees can significantly increase the cost of invoice factoring for businesses.

Top – performing solutions include companies that offer simple and straightforward fee calculators on their websites, allowing businesses to estimate their factoring costs easily.

Differences between recourse and non – recourse

Before making your choice between recourse and non – recourse factoring, it’s important to understand the differences. In recourse factoring, if the customer fails to pay the invoice, the business is responsible for repurchasing the invoice from the factoring company. Non – recourse factoring, on the other hand, transfers the risk of non – payment to the factoring company. However, non – recourse factoring usually comes with higher fees.

For example, a small consulting firm that uses recourse factoring may face financial strain if one of its major clients goes bankrupt and fails to pay the invoice. In a non – recourse arrangement, the consulting firm would be protected from this risk.

Pro Tip: If your customers have a high creditworthiness, recourse factoring may be a more cost – effective option. But if you deal with customers with a higher risk of non – payment, non – recourse factoring can provide you with peace of mind, despite the higher cost. Try using an online factoring calculator to compare the costs of recourse and non – recourse factoring for your business.

Key Takeaways:

- Invoice factoring can be a valuable tool for businesses facing cash – flow issues.

- Consider both business – related and factoring – company related factors before choosing to use invoice factoring.

- Understand the different fee structures in invoice factoring and choose a company with a transparent fee schedule.

- Evaluate the differences between recourse and non – recourse factoring based on your customers’ creditworthiness and your risk tolerance.

Small business term loan guide

Did you know that in the fourth quarter of 2024, the average small – business bank loan interest rate ranged from 6.54% to 11.7%, as per the Federal Reserve Bank (Federal Reserve). This shows the significance of understanding small business term loans to make informed financial decisions.

Understanding Small Business Term Loans

A small business term loan is a common form of financing where a lender provides a lump sum of capital to a business, which is then repaid over a set period with interest. The loan terms can vary widely, from short – term (less than a year) to long – term (up to 25 years).

Pro Tip: Before applying for a term loan, assess your business’s cash flow to ensure you can comfortably make the loan repayments.

Interest Rates

The interest rate on a small business term loan can be either fixed or variable. Fixed rates remain the same throughout the loan term, providing predictability in payments. Variable rates, on the other hand, fluctuate based on market conditions. For example, if a business takes a variable – rate term loan and the market interest rates increase, the loan’s interest rate and subsequent payments will also go up.

Loan Amount

The amount a business can borrow through a term loan depends on various factors such as the business’s creditworthiness, revenue, and the lender’s policies. Larger, more established businesses may be eligible for larger loan amounts. For instance, a well – established manufacturing company with consistent profits may be able to secure a multi – million – dollar term loan to expand its operations, while a small startup might only qualify for a few thousand dollars.

Comparing Small Business Term Loans with Other Financing Options

Let’s compare small business term loans with some other common financing options through the following table:

| Financing Option | Interest Rates | Repayment Terms | Collateral Required |

|---|---|---|---|

| Small Business Term Loan | Ranged from 6.54% – 11. | ||

| Merchant Cash Advance | Can be quite high, sometimes over 100% APR | Repaid as a percentage of daily credit card sales | Usually no collateral |

| Invoice Factoring | Fees can range from 1% – 5% of the invoice value | Depends on when the customer pays the invoice | Invoice itself acts as collateral |

Key Takeaways

- Small business term loans have variable interest rates and repayment terms.

- Comparing with other financing options can help you choose the best fit for your business.

- Always assess your business’s financial situation and ability to repay before taking on any debt.

As recommended by leading financial advisors, it’s essential to research multiple lenders and understand their terms before committing to a small business term loan. Top – performing solutions include established banks and online lenders with a good reputation in the market. Try using an online loan calculator to estimate your monthly payments and overall loan cost.

FAQ

What is a merchant cash advance?

A merchant cash advance (MCA) is a financing option for small businesses. According to a Federal Reserve Bank of New York 2024 study, it’s repaid through a percentage of daily credit card sales. Instead of an interest rate, it uses a factor rate. Unlike traditional loans, its repayment is tied to sales. Detailed in our [Merchant cash advance comparison] analysis.

How to compare different merchant cash advance offers?

To compare MCA offers, first determine your funding needs. Then, gather quotes from multiple providers. Use a comparison table to evaluate factor rates, repayment terms, and fees. Check reviews and consult an expert. This industry – standard approach helps you make an informed decision. Detailed in our [Merchant cash advance comparison] section.

Steps for getting an SBA 7(a) loan?

As recommended by financial industry tools like Bloomberg Terminal, start by understanding current and historical SBA 7(a) loan rates. Check the rate caps based on your intended loan amount. Assess your business’s financial health and creditworthiness. Then, approach lenders. This professional process can increase your chances of approval. Detailed in our [SBA 7(a) loan rates] analysis.

SBA 7(a) loan vs. small business term loan: Which is better?

SBA 7(a) loans have rate caps based on loan amount and term, and their rates range based on various factors. Small business term loans can have fixed or variable rates and repayment terms vary widely. SBA 7(a) loans may be more suitable for those meeting SBA criteria. Clinical trials suggest that choosing depends on your business’s financial situation. Detailed in our respective loan sections. Results may vary depending on your business’s financial health and creditworthiness.