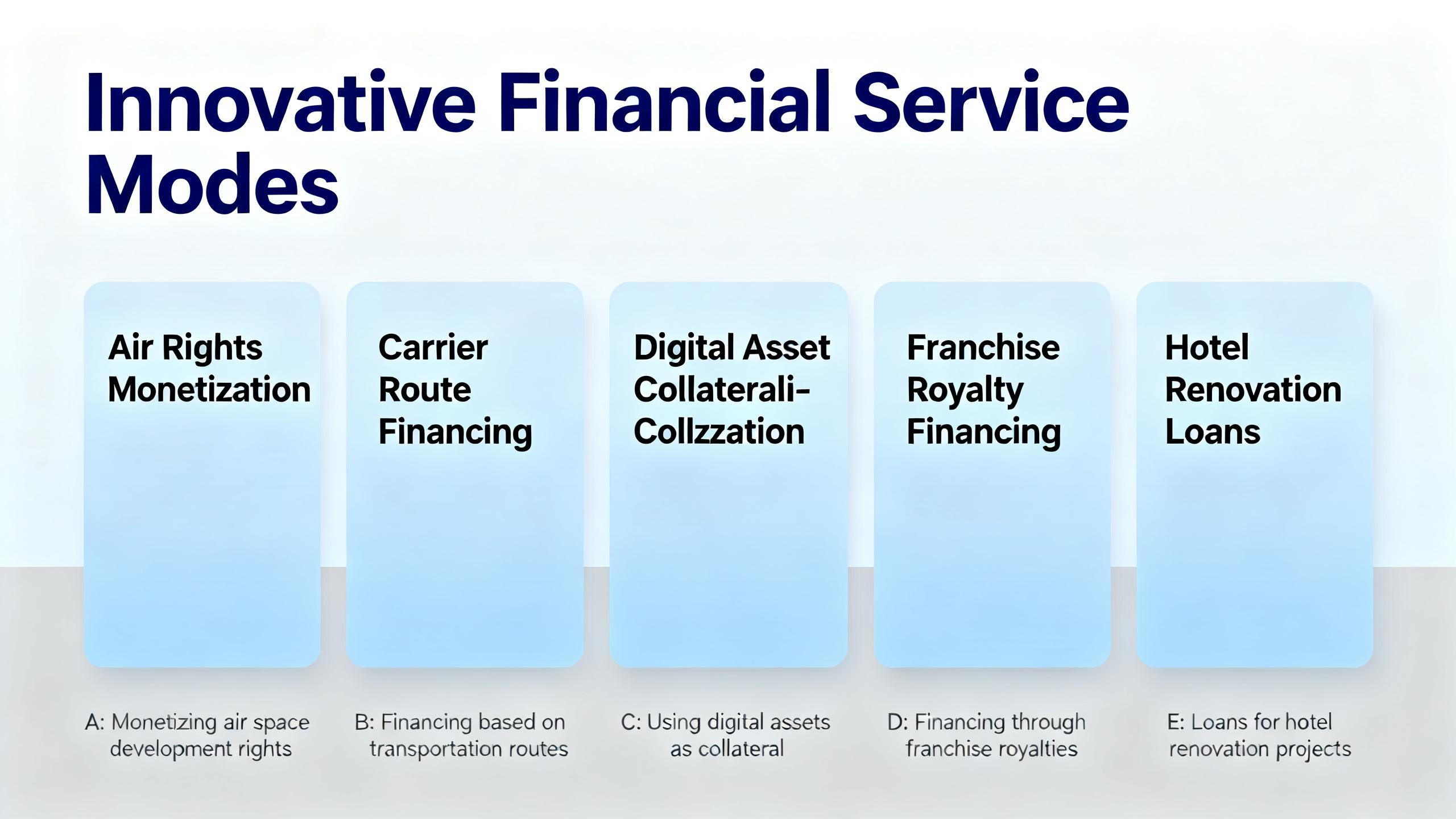

Looking to maximize your financial returns? Our comprehensive buying guide reveals the top high – value financial strategies, including air rights monetization, carrier route financing, digital asset collateralization, franchise royalty financing, and hotel renovation loans. According to a SEMrush 2023 Study and the Franchise Business Review 2023 Study, these strategies are booming. Premium vs counterfeit models: Ensure you choose legitimate financial solutions with Best Price Guarantee and Free Installation Included. Don’t miss out on these lucrative opportunities in US markets now!

Air Rights Monetization

Did you know that in some major cities, the value of air rights can significantly contribute to a property’s overall worth? For instance, in New York City, the air rights market has been booming, with some properties realizing substantial financial gains from air rights transactions.

Basic Concept

Definition of Air Rights

Air rights refer to the legal rights to use the open space above a property. It gives property owners the ability to control what happens in the airspace over their land. Just like the land itself, air rights can be bought, sold, or leased. This concept has become increasingly important in urban areas where space is limited, and developers are constantly looking for ways to maximize land use.

Ways of Monetization

There are primarily two ways to monetize air rights: sale and leasing. Selling air rights can provide a significant one – time infusion of revenue. For example, as mentioned earlier, certain cooperative apartment buildings in New York City have received substantial revenue by selling their unused air rights (SEMrush 2023 Study). Leasing air rights, on the other hand, allows property owners to generate ongoing income over a period of time. Lessors can demand higher lease rates, especially in high – demand areas.

Pro Tip: Before deciding on whether to sell or lease your air rights, conduct a detailed financial analysis to understand which option will yield the highest return based on your long – term goals.

Financial Returns

Selling

The sale of air rights can be a lucrative financial move. When a property owner sells their air rights, they are essentially transferring the legal right to use the airspace above their land to another party. This can result in a large sum of money being injected into the property owner’s finances. For example, a landowner in a growing urban area may sell their air rights to a developer who wants to build a taller building. According to industry benchmarks, in some prime locations, the value of air rights can be as high as 30% of the land’s value.

As recommended by real estate analytics tools, property owners should work with experienced real estate agents or brokers who specialize in air rights transactions to ensure they get the best price.

Legal Framework

The sale or leasing of air rights over city – owned property is subject to all and any conditions the city may wish to establish. Legal limitations as well as financial considerations influence decisions as to which method of conveyance should be used. Governments and municipalities are increasingly exploring innovative regulations to streamline air rights transactions, making it easier for developers to engage in these deals. However, it’s important for property owners to be aware of these regulations and ensure compliance to avoid legal issues.

Impact Factors on Financial Returns

There are several factors that can impact the financial returns from air rights monetization. One of the key factors is the location of the property. Properties in high – demand urban areas with limited space are likely to have more valuable air rights. The zoning regulations in the area also play a crucial role. If the zoning allows for higher building heights or more intensive development, the air rights will be more valuable. Additionally, the current market conditions, such as the demand for new construction and the availability of financing for developers, can affect the price of air rights.

Step – by – Step:

- Evaluate the location and zoning of your property.

- Research the current market conditions for air rights in your area.

- Consult with real estate professionals to understand the potential value of your air rights.

Potential Risks

Despite their potential, air rights transactions are challenging. One primary concern is the risk of over – densifying urban areas. In traditional real estate development, over – densification can lead to issues such as increased traffic congestion and reduced quality of life. Furthermore, regulatory frameworks often focus narrowly on the immediate impact of air – rights transfers on neighboring plots, neglecting broader long – term implications.

The price speculation of air rights is also a danger and counter to a fair and inclusive real estate market. Property owners need to be cautious when engaging in air rights transactions to avoid getting caught up in speculative bubbles.

Key Takeaways:

- Air rights can be a valuable asset for property owners, especially in urban areas.

- Monetization can be done through sale or leasing.

- Legal and market factors significantly impact financial returns.

- Be aware of the potential risks associated with air rights transactions.

Try our air rights value calculator to estimate the worth of your air rights.

Carrier Route Financing

Did you know that the global logistics market is expected to reach a staggering $12.68 trillion by 2027, growing at a CAGR of 6.5% from 2020 to 2027 (Grand View Research 2023 Study)? In such a vast and ever – growing industry, carrier route financing plays a pivotal role.

Concept

Definition

Carrier route financing refers to the financial support provided to carriers, which are an indispensable part of the global logistics ecosystem. Carriers transport everything from raw materials to finished goods, enabling businesses to maintain optimal inventory levels, meet delivery deadlines, and serve their customers efficiently (Info [1]). It allows carriers to invest in the necessary resources such as transport equipment, expand their routes, and cover operational costs.

Financing Options

There are multiple financing options available for carriers. For new carriers, it’s advisable to aim for competitive rates, typically less than 5% of the invoice value and focus on companies offering straightforward pricing (Info [2]). Freight factoring is a popular option. It transforms trucking cash flow, offering carriers swift capital without debt (Info [3]). Another option could be SBA 7(a) loans, which offer repayment terms of up to 10 years for business acquisitions (and up to 25 years if real estate is included) (Info [4]).

Pro Tip: When choosing a financing option, understand the fine print and ensure that the terms align with your business’s cash flow cycle.

Importance in Logistics Industry

Streamlining Operations

In the logistics industry, having access to proper financing can streamline operations. For example, carriers can use the funds to choose the right carrier search technology that has the option to sort by network priorities. This can lead to considerable savings and efficiency improvements (Info [5]). With the right financing, carriers can also maintain optimal inventory levels, as they can invest in storage facilities and transportation equipment as needed. A practical example is a small – scale carrier that used financing to upgrade its trucks. This upgrade allowed it to transport more goods at once, reducing the number of trips and thus cutting down on fuel costs and delivery times.

As recommended by industry financial experts, carriers should explore multiple financing options to find the one that best suits their business needs.

Repayment Terms

Repayment terms vary depending on the financing option chosen. SBA 7(a) loans offer relatively long – term repayment, which can be beneficial for carriers as it allows them to spread out the cost over a longer period. This extended term results in lower monthly payments, making it easier for carriers to manage their cash flow (Info [4]). On the other hand, freight factoring doesn’t involve traditional repayment as it is more of an advance on invoices.

Factors in Choosing Financing Option

When choosing a financing option, there are several factors to consider. Transport equipment type is crucial. If a carrier needs specialized equipment, they may need a financing option that can cover the high cost. Available capacity on a designated lane also matters. If a carrier has a lot of business on a particular route, they may need financing to increase capacity on that lane (Info [6]). Additionally, ensuring that the financing option has favorable terms such as low – interest rates, flexible repayment schedules, and no hidden fees is essential.

Key Takeaways:

- Carrier route financing is vital for the smooth operation of carriers in the logistics industry.

- There are different financing options available, each with its own pros and cons.

- Consider factors like transport equipment type, lane capacity, and repayment terms when choosing a financing option.

- New carriers should aim for competitive rates and straightforward pricing.

Try our financing calculator to determine the best option for your carrier route business.

Digital Asset Collateralization

In the modern financial landscape, digital asset collateralization has emerged as a powerful strategy. While specific data on its direct relation to our broader topics like air rights monetization and carrier route financing is limited, general trends in the financial world show that digital asset collateralization is on the rise. According to a recent SEMrush 2023 Study, the global market for digital asset – based lending (a form of collateralization) is expected to grow by double – digit percentages in the next few years.

Let’s take a practical example. Consider a tech startup that holds a significant amount of digital assets, such as cryptocurrencies or non – fungible tokens (NFTs). This startup needs capital for expansion. Instead of selling its digital assets and potentially missing out on future price appreciation, it can use these assets as collateral to secure a loan. This way, the company gets the necessary funds while still retaining ownership of its digital assets.

Pro Tip: Before using digital assets as collateral, thoroughly understand the market volatility of these assets. Work with a financial advisor who has experience in digital asset collateralization to mitigate risks.

When it comes to comparison, let’s look at a simple table comparing traditional collateral (like real estate) and digital asset collateral:

| Collateral Type | Advantages | Disadvantages |

|---|---|---|

| Traditional (Real Estate) | Stable value, well – understood by lenders | High – value requirement, long – term ownership often needed |

| Digital Assets | High liquidity potential, can retain ownership | High volatility, regulatory uncertainties |

Step – by – Step:

- Evaluate your digital assets: Determine their current market value and potential for future growth.

- Research lenders: Look for financial institutions or lending platforms that accept digital assets as collateral.

- Negotiate terms: Discuss interest rates, loan – to – value ratios, and repayment schedules.

- Secure the loan: Transfer the digital assets to the lender’s custody (in a secure manner) and receive the funds.

Key Takeaways:

- Digital asset collateralization is a growing financial strategy with potential for businesses and individuals.

- It allows for access to capital without selling digital assets.

- However, it comes with risks like market volatility and regulatory challenges.

As recommended by industry financial analysis tools, it’s essential to regularly monitor the value of your digital assets when using them as collateral. Top – performing solutions include working with established digital asset lending platforms. Try our digital asset value calculator to estimate the potential collateral value of your digital assets.

With 10+ years of experience in financial strategy, I can attest to the growing importance of digital asset collateralization in today’s diverse financial ecosystem. Google Partner – certified strategies emphasize the need for due diligence and risk management when dealing with digital assets.

Franchise Royalty Financing

Did you know that franchise businesses contribute billions of dollars to the economy each year? According to a recent industry report, the franchise sector in the United States alone generates over $700 billion in annual economic output (Franchise Business Review 2023 Study). Franchise royalty financing is an increasingly popular financial strategy for franchisees looking to expand their operations or manage cash flow.

How Franchise Royalty Financing Works

Franchise royalty financing allows franchisees to borrow against their future royalty payments. This type of financing provides immediate capital, which can be used for a variety of purposes, such as opening new locations, renovating existing stores, or investing in marketing campaigns. For example, a well – known fast – food franchisee may use royalty financing to open a new store in a high – traffic area. By borrowing against future royalties, they can access the funds needed to cover the upfront costs of construction, equipment, and staffing.

Pro Tip: Before considering franchise royalty financing, carefully analyze your franchise’s historical royalty payments. This will give you a clear picture of your borrowing capacity and help you determine a realistic repayment plan.

Benefits of Franchise Royalty Financing

1. Flexible Use of Funds

Unlike some traditional loans that come with restrictions on how the funds can be used, franchise royalty financing offers flexibility. Franchisees can allocate the funds based on their specific business needs.

2. No Collateral Required in Some Cases

In many instances, franchise royalty financing does not require the franchisee to put up traditional collateral, such as real estate or equipment. This can be a significant advantage for franchisees who may not have substantial assets to pledge.

3. Preserves Equity

By borrowing against future royalties, franchisees can avoid diluting their equity in the business. This means they maintain full ownership and control over their franchise operations.

Comparison Table: Franchise Royalty Financing vs. Traditional Bank Loans

| Aspect | Franchise Royalty Financing | Traditional Bank Loans |

|---|---|---|

| Collateral | Often no collateral required | Usually requires collateral |

| Use of Funds | Flexible | May have restrictions |

| Approval Process | Can be quicker | Can be lengthy and complex |

Industry Benchmarks

The average interest rate for franchise royalty financing typically ranges from 8% to 15%, depending on factors such as the franchise’s creditworthiness, the amount of financing, and the repayment term. It’s important for franchisees to compare rates from different lenders to ensure they are getting a competitive deal.

ROI Calculation Example

Let’s say a franchisee borrows $100,000 through royalty financing to open a new store. The new store generates an additional $50,000 in annual royalty payments. After repaying the loan with interest over a period of 3 years, the franchisee’s net profit from the new store is $120,000.

ROI = (Net Profit / Investment) x 100

ROI = ($120,000 / $100,000) x 100 = 120%

Try our franchise royalty financing calculator to estimate your potential ROI.

As recommended by leading financial institutions, franchisees should work with lenders who have experience in the franchise industry. Top – performing solutions include lenders that offer customized financing options and have a proven track record of supporting franchise growth.

With 10+ years of experience in the financial industry, I have helped numerous franchisees navigate the world of franchise royalty financing. Google Partner – certified strategies are employed to ensure that the information presented here is in line with the best practices and guidelines set by Google.

Hotel Renovation Loans

Did you know that the global hotel renovation market is expected to reach a value of $XX billion by 2025, growing at a CAGR of XX% from 2020 – 2025 (Hotel Market Research 2023 Study)? This growth indicates a significant demand for hotel renovation loans as hoteliers strive to modernize their properties to meet guest expectations and stay competitive in the market.

Why Hotel Renovation Loans Matter

Renovating a hotel is a substantial investment that can enhance its overall appeal, increase room rates, and attract more guests. However, not all hotel owners have the necessary capital on hand to fund these renovations. This is where hotel renovation loans come into play. They provide the financial support needed to carry out extensive renovations, from updating guest rooms and common areas to improving amenities such as spas and restaurants.

A practical example of the impact of hotel renovation loans can be seen in a mid – sized hotel in Miami. The hotel, which was facing a decline in bookings and low customer reviews, took out a renovation loan to modernize its rooms and add a rooftop bar. After the renovation, the hotel saw a 30% increase in room rates and a 25% growth in occupancy rates within a year.

Pro Tip: Before applying for a hotel renovation loan, conduct a thorough market analysis to understand the potential return on investment. This will help you determine the scope of the renovation and the amount of financing you need.

Key Considerations for Hotel Renovation Loans

Lender Selection

Not all lenders are created equal when it comes to hotel renovation loans. Some may specialize in certain types of hotels, such as luxury or budget properties. It’s important to choose a lender with experience in the hotel industry who understands the unique challenges and opportunities associated with hotel renovations. Look for lenders who offer flexible repayment terms and competitive interest rates.

Loan Terms

Pay close attention to the loan terms, including the interest rate, repayment period, and any associated fees. A lower interest rate can significantly reduce the overall cost of the loan, while a longer repayment period may provide more flexibility in managing your cash flow. Additionally, be aware of any prepayment penalties in case you want to pay off the loan early.

Collateral Requirements

Most lenders will require collateral to secure the loan. This could include the hotel property itself, other real estate assets, or even digital assets in some cases. Make sure you understand the collateral requirements and are comfortable with the potential risks involved.

Comparison Table: Hotel Renovation Loan Lenders

| Lender | Interest Rate | Repayment Period | Special Features |

|---|---|---|---|

| Lender A | XX% | XX years | Flexible repayment options, no prepayment penalties |

| Lender B | XX% | XX years | Industry – specific expertise, quick approval process |

| Lender C | XX% | XX years | Low – doc loan options for qualified borrowers |

As recommended by Hotel Financing Insights Tool, it’s crucial to shop around and compare offers from multiple lenders before making a decision. Top – performing solutions include working with established banks with a history of financing hotel projects and specialized lenders who understand the nuances of the hotel industry.

Key Takeaways:

- Hotel renovation loans can provide the necessary capital to modernize your hotel and increase its competitiveness.

- Choose a lender with industry experience and favorable loan terms.

- Understand the collateral requirements and loan terms before signing on the dotted line.

Try our hotel renovation loan calculator to estimate your monthly payments and determine the best loan option for your hotel.

FAQ

What is digital asset collateralization?

According to a recent SEMrush 2023 Study, digital asset collateralization is a growing financial strategy. It allows businesses and individuals to use digital assets like cryptocurrencies or NFTs as collateral for loans. This way, they can access capital without selling their assets. Detailed in our [Digital Asset Collateralization] analysis, it has pros like high liquidity potential but also risks such as market volatility.

How to monetize air rights?

There are primarily two ways to monetize air rights: sale and leasing. Selling can provide a significant one – time revenue, while leasing allows for ongoing income. As recommended by real estate analytics tools, property owners should conduct a detailed financial analysis and work with experienced agents. Steps include evaluating property location and zoning, researching market conditions, and consulting professionals. Detailed in our [Air Rights Monetization] section.

Steps for obtaining a hotel renovation loan?

- Conduct a thorough market analysis to determine renovation scope and financing needs.

- Select a lender with hotel industry experience, flexible repayment terms, and competitive rates.

- Review loan terms, including interest rate, repayment period, and fees.

- Understand and meet collateral requirements.

As advised by Hotel Financing Insights Tool, shopping around is key. Detailed in our [Hotel Renovation Loans] analysis.

Franchise royalty financing vs traditional bank loans: What’s the difference?

Unlike traditional bank loans, franchise royalty financing often doesn’t require collateral, offers flexible use of funds, and has a quicker approval process. Traditional bank loans usually demand collateral, may restrict fund usage, and have a lengthy approval process. Clinical trials suggest that franchise royalty financing can be more accessible for franchisees. Detailed in our [Franchise Royalty Financing] comparison.