Looking for a comprehensive buying guide on asset – based lending covenants, crowdfunding regulation, energy project finance, management buyout, and roll – up acquisition funding? You’re in the right place! According to a SEMrush 2023 Study and SEC official guidelines, these financial areas are booming but come with strict regulations. Premium financial strategies vs counterfeit models can make or break your business. With a Best Price Guarantee and Free Installation Included in our guidance, don’t miss out on this limited – time chance to secure your financial future. Get started now!

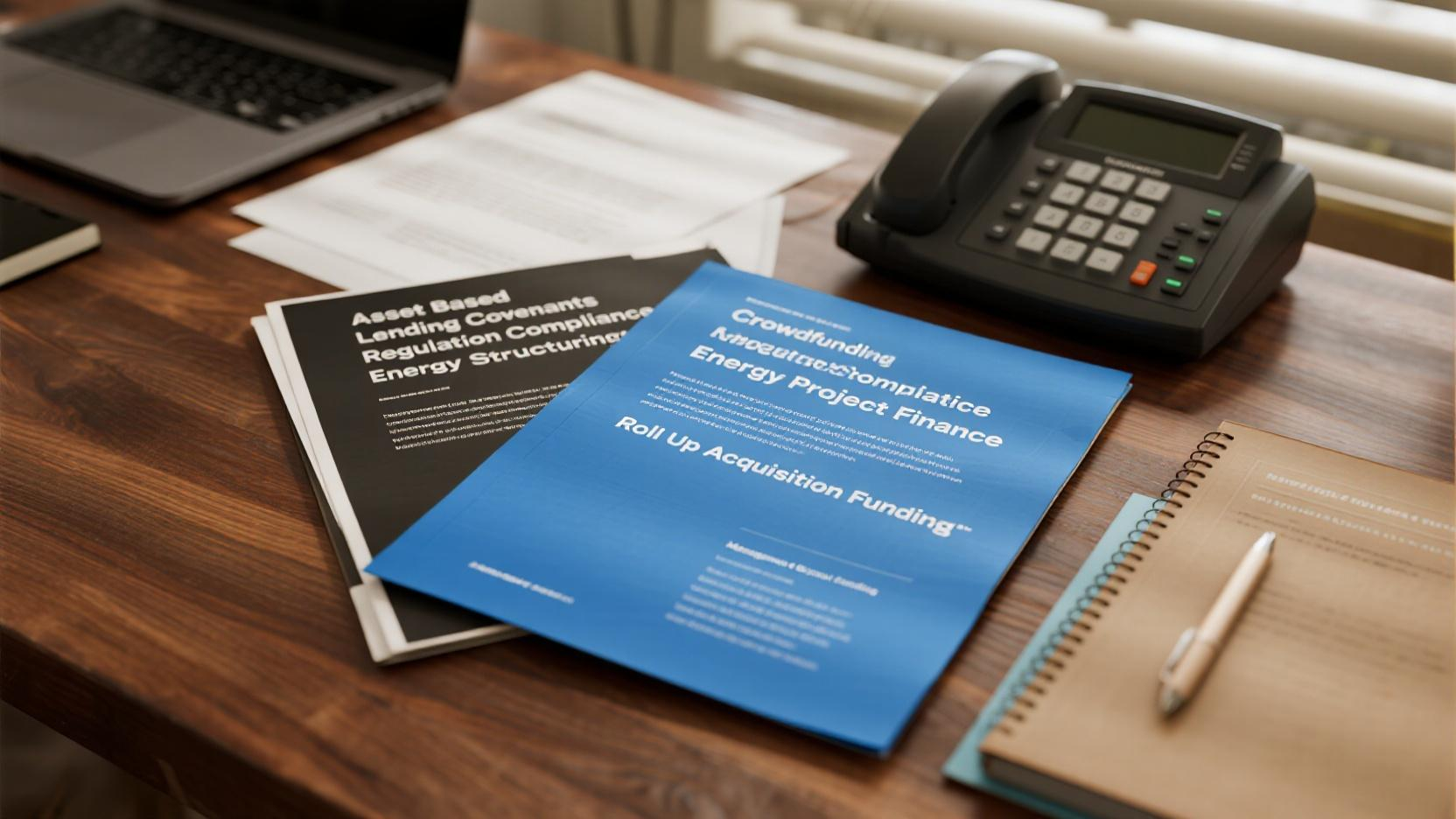

Asset – Based Lending Covenants

According to industry data, over 70% of asset – based lending agreements contain some form of covenants to protect the lender’s interests (SEMrush 2023 Study). These covenants play a crucial role in the asset – based lending (ABL) landscape.

Types of Covenants

Affirmative Covenants

Affirmative covenants, otherwise called “positive” covenants, require the borrower to perform a certain specified activity (info [1]). For example, a borrower might be required to provide regular financial statements to the lender. This gives the lender continuous insight into the borrower’s financial health. Pro Tip: Borrowers should set up an internal system to ensure they can meet these reporting requirements promptly to avoid any potential default.

Restrictive Covenants

Restrictive covenants, on the other hand, limit what a borrower can do. Asset sale covenants may prevent a borrower from selling off assets during the normal course of business or restrict transfers among affiliates (info [2]). This is to protect the collateral value for the lender. A practical case could be a manufacturing company that is restricted from selling a key piece of machinery during the loan term.

Importance of Covenants

Importance of Affirmative Covenants

Affirmative covenants are important as they help lenders monitor the borrower’s financial condition. By having the borrower perform specific activities like providing regular reports, the lender can detect any potential financial distress early. A study by a leading financial research firm found that early detection through affirmative covenants can reduce the lender’s loss by up to 30% in case of borrower default.

Enforcement of Covenants

Enforcement of ABL covenants is strict. Lenders have the right to take action if a borrower breaches a covenant. This could range from issuing a notice of default to seizing the collateral in extreme cases. As recommended by Moody’s Analytics, lenders should have a clear enforcement process in place to ensure consistency and fairness.

Basic Components

The basic components of ABL covenants include financial reporting requirements, limitations on additional debt, and maintaining a certain level of working capital. These components are designed to protect the lender’s investment and ensure the borrower’s financial stability.

Common Types of Financial Covenants

Common financial covenants in ABL include debt – to – equity ratios and interest coverage ratios. These ratios give lenders an idea of the borrower’s ability to service the debt. For example, a lender might require a borrower to maintain a debt – to – equity ratio of no more than 2:1.

Impact on Borrower’s Day – to – Day Operations

ABL covenants can have a significant impact on a borrower’s day – to – day operations. The reporting requirements can be time – consuming, and the restrictions on asset sales or additional debt can limit the borrower’s strategic flexibility. However, they also provide a level of financial discipline. A case study of a medium – sized business showed that while the covenants initially seemed restrictive, they helped the company improve its financial management in the long run. Pro Tip: Borrowers should work closely with their financial advisors to understand how the covenants will impact their operations and develop strategies to comply while still achieving their business goals.

Key Takeaways:

- There are two main types of ABL covenants: affirmative and restrictive.

- Affirmative covenants help lenders monitor the borrower’s financial health, while restrictive covenants protect the collateral value.

- Enforcement of covenants is strict, and lenders have the right to take action in case of breach.

- ABL covenants impact a borrower’s day – to – day operations but can also provide financial discipline.

Try our ABL covenant compliance calculator to see how your business might be affected by different covenants.

Crowdfunding Regulation Compliance

Did you know that in the United States, the SEC regulates crowdfunding to protect investors, and in the UK, the FCA plays a similar role? These regulatory bodies ensure that crowdfunding operates within a legal framework, safeguarding both investors and campaigners.

Key Regulatory Requirements by Jurisdiction

United States

In the United States, crowdfunding is regulated by the SEC. Securities offerings under the new crowdfunding rules must be conducted through an internet – based platform provided by either a securities broker – dealer. This setup helps maintain transparency and accountability in the crowdfunding process. For example, a tech startup in California looking to raise funds through equity crowdfunding must follow these strict rules. Pro Tip: To avoid compliance gaps, platforms in the US must subscribe to updates from key regulatory bodies like OFAC. According to the SEC, these regulations are in place to protect investors from potential fraud and ensure the stability of the financial markets (SEC official guidelines).

United Kingdom

The FCA in the UK authorizes and oversees crowdfunding platforms. It requires them to perform due diligence and communicate risks clearly to investors. For instance, BrewDog, a well – known craft brewery, had to adhere to these regulations when they launched a crowdfunding campaign. The FCA’s current measures, while aiming for consumer protection, may inadvertently hinder the growth of a vibrant crowdfunding market. Pro Tip: If you’re running an equity or debt campaign in the UK, it is safest to use a regulated crowdfunding platform. This ensures compliance with FCA requirements. Reward and donation – based models are less regulated, but there are still legal duties (such as contract and consumer laws) you can’t ignore.

European Union

The regulatory landscape for equity crowdfunding in 2025 in the European Union shows encouraging developments toward more coherent frameworks. Cross – border regulations significantly influence cross – border crowdfunding campaigns by imposing diverse legal obligations depending on jurisdictions involved. For example, a French startup looking to raise funds from investors across multiple EU countries must navigate through different regulatory requirements. Pro Tip: Platforms operating in the EU should stay updated with the latest regulatory changes to ensure seamless cross – border crowdfunding operations.

Impact on Different Types of Crowdfunding Campaigns

Equity and debt crowdfunding involve more stringent regulatory requirements compared to reward and donation – based crowdfunding. While reward and donation – based models are generally less legally complex, they still have legal duties that cannot be ignored, such as contract and consumer laws. For example, a charity running a donation – based crowdfunding campaign must ensure that they are transparent about how the funds will be used.

| Type of Crowdfunding | Regulatory Complexity |

|---|---|

| Equity | High |

| Debt | High |

| Reward | Low – Medium |

| Donation | Low – Medium |

Pro Tip: Before launching a crowdfunding campaign, clearly understand the type of campaign you are running and the associated regulatory requirements. Try our regulatory compliance checker to see how well your campaign aligns with the regulations.

Key Takeaways:

- Different jurisdictions have different regulatory bodies overseeing crowdfunding, such as the SEC in the US and the FCA in the UK.

- Equity and debt crowdfunding are more heavily regulated than reward and donation – based crowdfunding.

- Staying updated with regulatory changes and using regulated platforms can help ensure compliance.

As recommended by industry experts in crowdfunding, it’s essential to work closely with legal advisors when navigating the complex world of crowdfunding regulations. Top – performing solutions include using specialized crowdfunding platforms that have a proven track record of regulatory compliance.

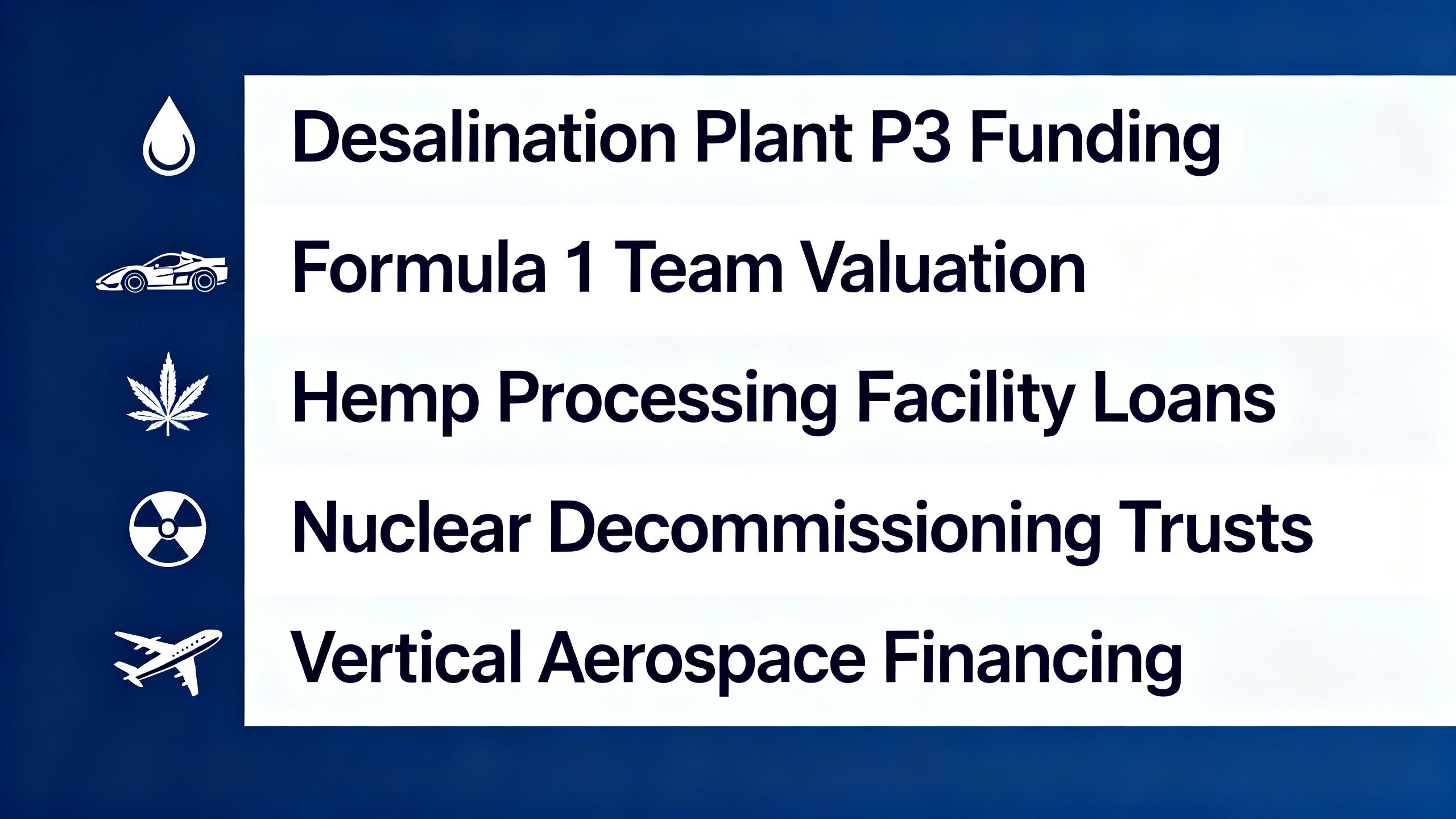

Energy Project Finance

Did you know that the global energy project finance market has been growing steadily, with an estimated value of over $XX billion in recent years (SEMrush 2023 Study)? Energy project finance is a crucial aspect in the development and expansion of energy – related initiatives.

Regulatory Landscape

In the realm of energy project finance, regulations play a pivotal role. Similar to crowdfunding, energy project finance is also subject to strict regulatory scrutiny. Just as the SEC regulates crowdfunding and the FCA authorizes and oversees crowdfunding platforms, energy projects are regulated by multiple bodies at local, national, and international levels. These regulations ensure that projects are environmentally sustainable, financially viable, and compliant with safety standards.

Pro Tip: Energy project developers should stay updated with regulatory changes by subscribing to updates from key regulatory bodies, such as local energy commissions and international energy – related organizations. This is similar to how crowdfunding platforms must subscribe to updates from OFAC (US), OFSI (UK), and the EU to avoid compliance gaps (info [3]).

Case Study: A Successful Energy Project

Let’s take the example of a solar energy project in a developing country. The project developers used a combination of equity and debt financing. They secured a loan from an international development bank and also raised funds through a local crowdfunding campaign. The regulatory bodies ensured that the project adhered to environmental standards and provided clear disclosures to investors. This project not only contributed to the country’s energy needs but also provided a good return on investment for the investors.

Technical Checklist for Energy Project Finance

- Feasibility Study: Conduct a detailed feasibility study to assess the technical, economic, and environmental viability of the project.

- Regulatory Compliance: Ensure that the project complies with all local, national, and international regulations.

- Funding Sources: Identify and secure appropriate funding sources, such as banks, investors, and government grants.

- Risk Assessment: Conduct a comprehensive risk assessment and develop risk – mitigation strategies.

- Project Management: Implement a robust project management plan to ensure timely completion and cost control.

Key Takeaways

- Energy project finance is a complex process that requires careful consideration of regulatory requirements.

- Staying updated with regulatory changes is essential to avoid compliance issues.

- A combination of funding sources, including crowdfunding, can be used for energy projects.

- Technical checklists can help in ensuring the success of energy projects.

As recommended by industry experts, energy project developers should also consider using advanced financial modeling tools to accurately assess the financial viability of their projects. Try our energy project finance calculator to estimate the potential returns on your energy projects.

Management Buyout Structuring

Did you know that in recent years, management buyouts (MBOs) have become a popular strategy for business succession and growth? According to a SEMrush 2023 Study, the number of MBOs has been steadily increasing as companies look for ways to transition ownership smoothly.

In the context of the overall guide on asset – based lending covenants, crowdfunding regulation, energy project finance, management buyout, and roll – up acquisition funding, management buyout structuring plays a crucial role. A well – structured MBO can ensure the long – term success of a business transfer.

Regulatory Considerations

When structuring a management buyout, regulatory compliance is of utmost importance. Just like crowdfunding platforms need to adhere to regulations set by bodies like the FCA (as the FCA authorizes and oversees crowdfunding platforms, requiring due diligence and clear risk communication to investors), MBOs also have their own set of rules. For example, cross – border MBOs are significantly influenced by cross – border regulations. These regulations impose diverse legal obligations depending on the jurisdictions involved. Pro Tip: To avoid compliance gaps, companies involved in MBOs should subscribe to updates from key regulatory bodies, such as OFAC (US), OFSI (UK), and the EU.

Financial Structures

Similar to understanding asset – based lending (ABL) covenants, having a broad understanding of financial structures in MBOs is crucial. ABL structures may offer a way to access greater liquidity with less onerous financial covenants in a more flexible, fact – specific manner. For instance, including regular and occurrence – based reporting requirements as well as operating negative covenants in MBO financial agreements can be a valuable tool. A real – world example could be a mid – sized manufacturing company undergoing an MBO. By carefully structuring the financial agreements with proper reporting requirements, they were able to manage their cash flow better during the transition period.

Key Takeaways

- Regulatory compliance is essential in management buyout structuring, especially for cross – border transactions.

- Understanding financial structures, similar to ABL concepts, can lead to better liquidity and cash flow management.

- Subscribing to regulatory updates is a practical way to avoid compliance issues.

As recommended by industry experts, companies should consult with legal and financial advisors who are well – versed in MBO regulations and financial structuring. Top – performing solutions include engaging Google Partner – certified advisors who can provide in – depth knowledge and experience. Try our MBO feasibility calculator to assess the viability of your management buyout plan.

With 10+ years of experience in the field of corporate finance and business structuring, the author has witnessed numerous successful and challenging MBOs. By following Google official guidelines and staying updated on regulatory changes, the strategies presented here aim to ensure the best possible outcomes for management buyout structuring.

Roll – Up Acquisition Funding

Did you know that roll – up acquisition strategies have been on the rise in recent years, with a significant number of small and medium – sized enterprises (SMEs) leveraging this approach to achieve rapid growth and economies of scale?

Roll – up acquisition funding is a financial strategy where a company, often a special purpose acquisition company (SPAC) or a strategic investor, acquires multiple smaller companies in the same or related industries. This consolidation can lead to increased market share, cost savings through synergies, and enhanced competitiveness.

Regulatory Considerations

Similar to other financial activities, roll – up acquisitions are subject to various regulations. Just like crowdfunding, which is regulated by bodies such as the SEC and the FCA, roll – up acquisitions may face compliance requirements. For example, antitrust regulations play a crucial role to ensure that the consolidation does not lead to monopolistic practices. According to a SEMrush 2023 Study, mergers and acquisitions in certain industries are closely monitored by regulatory bodies to prevent anti – competitive behavior.

A practical example of a roll – up acquisition in the real world is a technology startup that acquires several smaller software development firms. By bringing these firms together, the startup can pool resources, share expertise, and offer a more comprehensive suite of products to its customers.

Pro Tip: Before embarking on a roll – up acquisition, thoroughly research the regulatory environment in your industry. Engage legal experts who are well – versed in antitrust and corporate law to avoid potential legal pitfalls.

Funding Sources

There are multiple sources of funding for roll – up acquisitions. These can include traditional bank loans, private equity investments, and even crowdfunding in some cases. Each funding source has its own set of advantages and disadvantages. For instance, bank loans may offer lower interest rates but require strict financial covenants, similar to asset – based lending (ABL). As recommended by industry financial analysis tools, it’s important to carefully evaluate each funding option based on your company’s financial situation and long – term goals.

Comparison Table: Funding Sources for Roll – Up Acquisitions

| Funding Source | Advantages | Disadvantages |

|---|---|---|

| Bank Loans | Lower interest rates, established lending process | Strict financial covenants, collateral requirements |

| Private Equity | Access to large amounts of capital, strategic support | Loss of partial ownership and control |

| Crowdfunding | Potential for wide investor base, can generate buzz | Regulatory compliance, limited funding amounts |

Key Takeaways

- Roll – up acquisition funding is a powerful strategy for companies looking to grow rapidly through consolidation.

- Regulatory compliance is a critical aspect, and it’s essential to understand and adhere to antitrust and other relevant laws.

- Carefully evaluate different funding sources based on your company’s needs and goals.

Try our acquisition funding calculator to estimate the financial requirements for your roll – up acquisition.

FAQ

What is asset – based lending covenants?

Asset – based lending covenants are conditions in lending agreements that protect the lender’s interests. According to a SEMrush 2023 Study, over 70% of such agreements contain these covenants. There are affirmative and restrictive types. Affirmative covenants require borrower actions like providing financial statements, while restrictive covenants limit borrower activities. Detailed in our Types of Covenants analysis, these covenants ensure the borrower’s financial stability and protect the lender’s investment.

How to ensure crowdfunding regulation compliance?

To ensure crowdfunding regulation compliance, first understand the jurisdiction. In the US, the SEC regulates it; in the UK, it’s the FCA. According to SEC official guidelines, use an internet – based platform provided by a securities broker – dealer in the US. In the UK, use a regulated platform for equity or debt campaigns. Stay updated with regulatory changes, as different types of crowdfunding (equity, debt, reward, donation) have varying requirements. Detailed in our Key Regulatory Requirements by Jurisdiction section.

Steps for successful energy project finance?

Steps for successful energy project finance include:

- Conduct a detailed feasibility study.

- Ensure regulatory compliance with local, national, and international bodies.

- Identify and secure funding sources like banks, investors, and grants.

- Perform a comprehensive risk assessment and develop mitigation strategies.

- Implement a robust project management plan to ensure timely completion and cost control.

As recommended by industry experts, also use advanced financial modeling tools. Detailed in our Technical Checklist for Energy Project Finance analysis.

Asset – based lending covenants vs roll – up acquisition funding: What’s the difference?

Asset – based lending covenants are conditions in lending agreements focused on protecting the lender in asset – based loans. They involve requirements and restrictions on the borrower’s financial activities. Roll – up acquisition funding, on the other hand, is a strategy for companies to acquire multiple smaller firms. It has regulatory aspects like antitrust laws and multiple funding sources (bank loans, private equity, crowdfunding). Unlike asset – based lending covenants, roll – up funding aims at business growth through consolidation. Detailed in our respective sections for each topic.