Looking to make smart family office direct investments? Our comprehensive buying guide is a must – read! According to FINTRX and the Family Office Quarterly 2025 report, family offices are actively engaged in early – round funding and co – investment platforms. With 29.5% of family office investments in seed – stage and venture rounds, there’s huge potential in these areas. Compare premium co – investment platforms with counterfeit or less – effective models. We offer a Best Price Guarantee and Free Installation Included (for select services in local areas). Don’t miss out on these lucrative opportunities!

Family Office Direct Investments

Family offices are a significant force in the investment world, and understanding their direct investment strategies is crucial. According to FINTRX data, most family office investments occur throughout early – round funding, with 29.5% of these being made in the earlier seed – stage and venture rounds (FINTRX Study). This shows the strong interest family offices have in emerging opportunities.

Typical Deal Structures

Investment Forms

Family offices are favoring syndicated and "club deals." In these setups, families team up with other families to make an investment or take a back seat to a private equity firm leading the investment. For example, in a high – tech startup venture, multiple family offices might pool their resources together. This not only spreads the risk but also provides a larger capital base for the investment.

Pro Tip: When considering syndicated or club deals, family offices should clearly define each party’s roles and responsibilities from the start to avoid future conflicts.

Club Deal Structures

As recommended by investment industry experts, club deal structures are becoming increasingly popular among family offices. These structures allow family offices to manage and share risk effectively. For instance, if a family office invests in a large real – estate project through a club deal, it can limit its exposure while still having access to a potentially high – return opportunity.

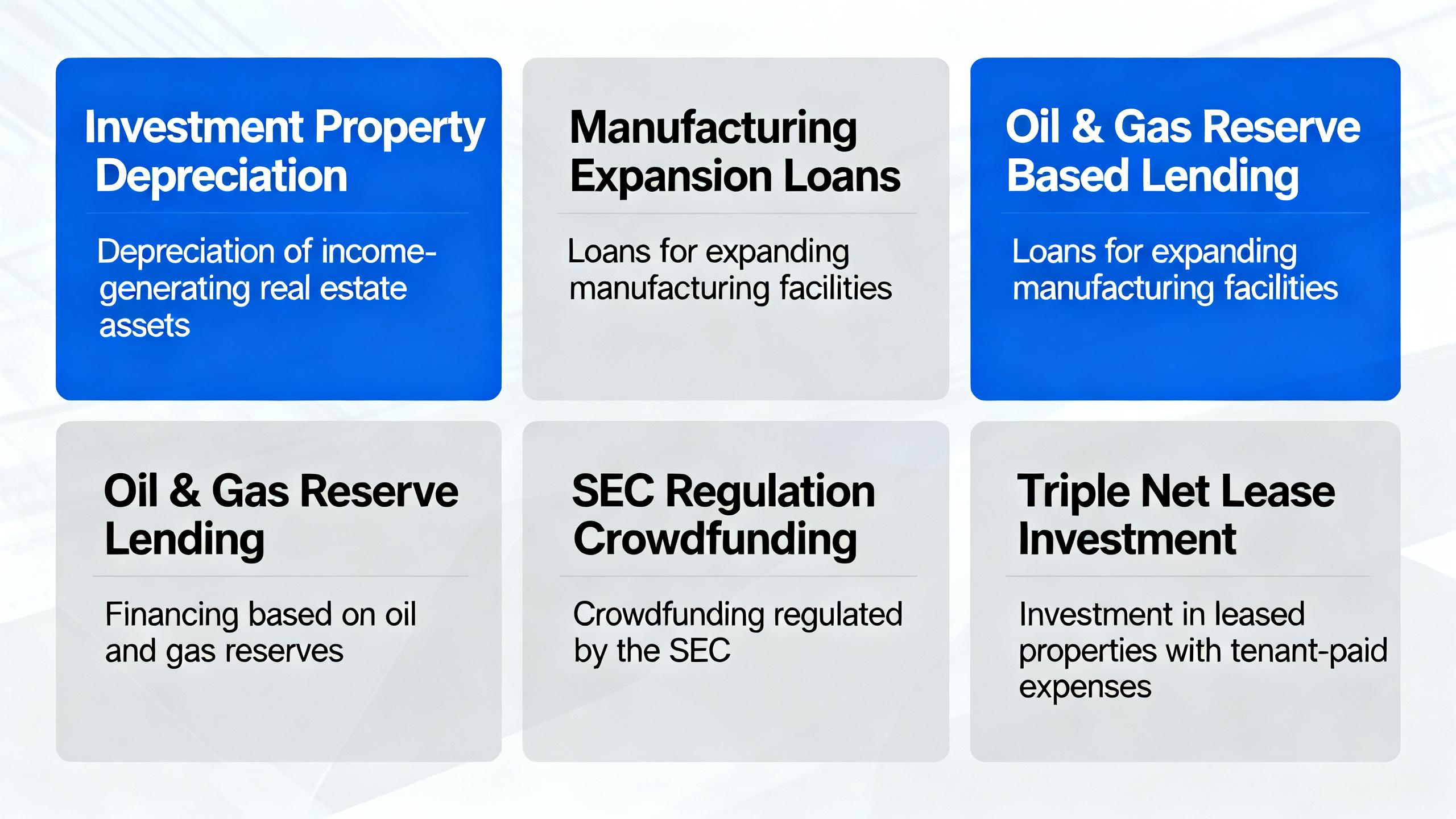

Comparison Table:

| Deal Structure | Risk Level | Potential Return | Control Level |

|---|---|---|---|

| Club Deals | Medium | High | Moderate |

| Direct Single Investments | High | High | High |

| Passive Syndication | Low | Moderate | Low |

Co – investment Strategies

Family offices are increasingly engaging in co – investment strategies, particularly in private equity and real estate sectors. Co – investments via Special Purpose Vehicles (SPVs) and direct syndicate partnerships are emerging as platforms enabling family office co – investments. This allows family offices to gain greater control over their investments and access exclusive private market opportunities.

Risk – Return Characteristics of Club Deal Structures

Club deal structures offer a balanced risk – return profile. On one hand, by sharing the investment with other parties, the risk is spread out. On the other hand, they still have the potential for high returns, especially when investing in high – growth sectors like technology or real estate. A case study of a club deal in the biotech industry showed that despite the initial risks associated with drug development, the collective expertise and financial resources of the family offices in the club deal led to a successful product launch and significant returns.

Pro Tip: Family offices should conduct in – depth market research and financial analysis of the club deal’s target investment to accurately assess its risk – return potential.

Common Characteristics

Across the industry, we are seeing the professionalization of family offices. This correlates with the increasing number of functions and responsibilities a family office is charged with, including accounting, legal services, and investment management. Family offices are also scaling up from their historically smaller – sized outfits, which gives them more bargaining power in the investment market.

Typical Asset Classes

Family offices often manage large and complex multi – asset portfolios spanning global markets. These typically include direct investments in real estate, venture capital, and private equity. In the credit space, there is a preference for Asia high – yield and frontier market debt, as the 2025 economic and market outlook suggests that central banks are cutting rates to balance growth and inflation.

Integration into Single – Family Office Strategies

Single – family offices (SFOs) have an opportunity to refine their strategies for the new macroeconomic environment. With the soft landing of the global economy seemingly within reach, SFOs can consider integrating direct investments into their long – term strategies. For example, by rebalancing their deals mix from direct investments to start – up deals and increasing their use of club deal structures, they can manage and share risk more effectively.

Step – by – Step:

- Analyze the current macroeconomic environment and market trends.

- Evaluate the family office’s risk tolerance and investment goals.

- Select the appropriate direct investment forms, such as club deals or co – investments.

- Conduct thorough due diligence on potential investments.

- Monitor and adjust the investment portfolio regularly.

Key Takeaways:

- Family offices have a preference for early – round funding, with a significant portion in seed – stage and venture rounds.

- Club deal structures and co – investment strategies are popular for risk management and accessing exclusive opportunities.

- Family offices are becoming more professionalized and are managing diverse multi – asset portfolios.

- Single – family offices should refine their strategies in the new macroeconomic environment.

Try our investment portfolio simulator to see how different family office direct investment strategies can impact your returns.

Single – Family Office Strategies

The financial landscape is ever – evolving, and single – family offices (SFOs) need to be on top of their game. According to FINTRX, 29.5% of family office investments are made in the earlier seed – stage and venture rounds, highlighting the significance of early – round funding in their investment portfolios. This statistic sets the stage for understanding the various strategies SFOs are adopting.

Popular Strategies

Refining for a New Macro – economic Environment

The trajectory of global interest rates and inflation dominated the global market narrative in 2024. Now, with a soft landing for the global economy seemingly within reach, SFOs have a chance to refine their strategies. After a period of short – term volatility, market conditions have stabilized enough to focus on long – term risks. For example, a single – family office that had been overly cautious during the volatile period can now re – evaluate its portfolio allocation to include more long – term growth assets.

Pro Tip: Family offices should conduct thorough due diligence and stress – test their portfolios for different economic scenarios. This will help them better prepare for any unforeseen market movements. As recommended by financial analytics tools, it’s essential to review and adjust investment strategies based on the changing macro – economic environment.

Thematic Investments

Family offices are increasingly favoring syndicated and "club deals." In these arrangements, families team up with other families to make an investment or take a back seat to a private equity firm leading the investment. This strategy allows SFOs to gain greater control over their investments and access exclusive private market opportunities. For instance, a group of family offices might come together to invest in a promising fintech startup through a club deal.

Pro Tip: When considering thematic investments like club deals, family offices should ensure they have a clear understanding of the investment goals and the roles of each participant. It’s also important to have a well – defined exit strategy. Top – performing solutions in this area often involve using legal and financial advisors with experience in club deals.

Exploring Emerging Markets

In the credit space, many SFOs are looking towards Asia high – yield and frontier market debt. The 2025 economic and market outlook suggests that central banks are cutting rates after aggressive hikes in 2022 and 2023, moving towards a more neutral monetary policy. This change in policy presents opportunities in emerging markets. A family office might invest in a high – yield bond in an emerging Asian economy, expecting higher returns as the market stabilizes.

Pro Tip: Before investing in emerging markets, family offices should research the political and economic stability of the target country. They should also understand the regulatory environment. Try our emerging market risk assessment tool to evaluate the potential of different emerging markets.

Challenges in Implementation

While these strategies offer potential rewards, there are challenges in implementation. Family offices often lack the same level of resources and expertise as institutional investors. Many family offices and their foundations can lack awareness of the strengths and limitations of their investment strategies. For example, they may not fully understand the risks associated with emerging market investments or club deals. Additionally, the professionalization of family offices is an ongoing process, and there may be difficulties in coordinating different functions such as accounting, legal services, and investment management.

Impact on Family Office Direct Investments

The strategies adopted by SFOs have a direct impact on family office direct investments. By targeting smaller and club deals, family offices are rebalancing their deals mix from direct investments in large and mega deals to start – up deals. This helps them manage and share risk more effectively. For instance, a family office that reduces its exposure to large direct deals and instead participates in multiple smaller club deals can spread its risk across different investments.

Key Takeaways:

- SFOs are refining their strategies for a new macro – economic environment, focusing on long – term risks.

- Thematic investments like syndicated and club deals are popular for gaining control and access to exclusive opportunities.

- Emerging markets, particularly in Asia and frontier economies, offer potential in the credit space.

- Challenges in implementation include lack of expertise and professionalization issues.

- These strategies are rebalancing family office direct investments to manage and share risk better.

Co – Investment Platforms

Did you know that family offices are increasingly turning to co – investment platforms? These platforms are not just a passing trend; they are becoming a crucial part of family office investment strategies.

Benefits

Access to Larger and Premium Deals

Family offices often face the challenge of accessing large and premium investment opportunities. However, co – investment platforms provide a solution. By pooling resources with other investors, family offices can participate in deals that would otherwise be out of their reach. For example, a single family office might not have the capital to invest in a large – scale real estate project. But through a co – investment platform, they can join forces with other investors and gain access to such premium deals.

A data – backed claim from FINTRX shows that by leveraging co – investment platforms, family offices are more likely to get involved in larger private equity and real estate deals. This gives them the chance to enter high – value markets and potentially earn significant returns. Pro Tip: When evaluating co – investment platforms for access to larger deals, look for those with a strong track record of successfully closing large – scale transactions. As recommended by industry experts, platforms that have a wide network of investors and a proven history of deal – making are more likely to provide access to premium opportunities.

Portfolio Diversification

Diversification is a key principle in investment. Co – investment platforms allow family offices to diversify their portfolios across different sectors, geographies, and asset classes. For instance, a family office primarily focused on domestic real estate can use a co – investment platform to invest in international private equity or venture capital opportunities. This diversification helps to reduce risk as the performance of different investments is not perfectly correlated.

According to the Family Office Quarterly 2025 report, family offices that have diversified their portfolios through co – investment platforms have been more resilient during market downturns. They are less likely to be severely affected by the underperformance of a single asset class. Pro Tip: Use co – investment platforms to target investments in sectors that are not currently well – represented in your portfolio. For example, if you have a large exposure to traditional stocks, consider using the platform to invest in alternative assets like commodities or hedge funds. Top – performing solutions include platforms that offer a wide range of investment options and provide detailed analytics to help you make informed diversification decisions.

Lower Fees

One of the significant advantages of co – investment platforms is the potential for lower fees. When family offices invest directly, they often incur high costs associated with deal sourcing, due diligence, and management. However, co – investment platforms can pool resources and spread these costs across multiple investors. This results in lower fees per investor.

For example, a family office investing directly in a private equity deal might have to pay a substantial upfront fee for deal origination. But by using a co – investment platform, they can share this cost with other investors, reducing their individual fee burden. A study by industry analysts found that family offices using co – investment platforms can save up to 20% on investment – related fees compared to direct investments. Pro Tip: Compare the fee structures of different co – investment platforms before choosing one. Look for platforms that offer transparent fee schedules and do not have hidden costs. Try our co – investment fee calculator to estimate the potential savings you can achieve.

Key Takeaways:

- Co – investment platforms offer family offices access to larger and premium deals that they might not be able to access individually.

- They enable portfolio diversification across different sectors, geographies, and asset classes, reducing investment risk.

- Co – investment platforms can result in lower fees as costs are shared among multiple investors.

FAQ

What is a co – investment platform in the context of family offices?

A co – investment platform in family offices allows them to pool resources with other investors. According to FINTRX, this enables access to larger and premium deals, such as large – scale real estate or private equity projects. It also aids in portfolio diversification across sectors, geographies, and asset classes. Detailed in our [Co – Investment Platforms] analysis, these platforms offer lower fees by spreading costs.

How to integrate direct investments into single – family office strategies?

To integrate direct investments, single – family offices should follow these steps:

- Analyze the current macro – economic environment and market trends.

- Evaluate the risk tolerance and investment goals.

- Select appropriate direct investment forms like club deals or co – investments.

As recommended by financial analytics tools, thorough due diligence on potential investments is crucial. This helps manage risk effectively, as detailed in our [Single – Family Office Strategies] section.

Steps for choosing the right co – investment platform for a family office?

When choosing a co – investment platform, family offices should:

- Look for platforms with a strong track record of closing large – scale transactions.

- Ensure the platform offers a wide range of investment options for diversification.

- Compare fee structures and choose those with transparent schedules.

Industry experts suggest platforms with a wide investor network are better. More on this in our [Co – Investment Platforms] discussion.

Club deals vs direct single investments: Which is better for family offices?

Unlike direct single investments that carry high risk but offer high control, club deals have a medium risk level and moderate control. According to the comparison table in the article, club deals allow risk sharing, making them suitable for risk – averse family offices. However, if a family office wants full control, direct single investments might be better. Results may vary depending on the family office’s risk tolerance and investment goals.