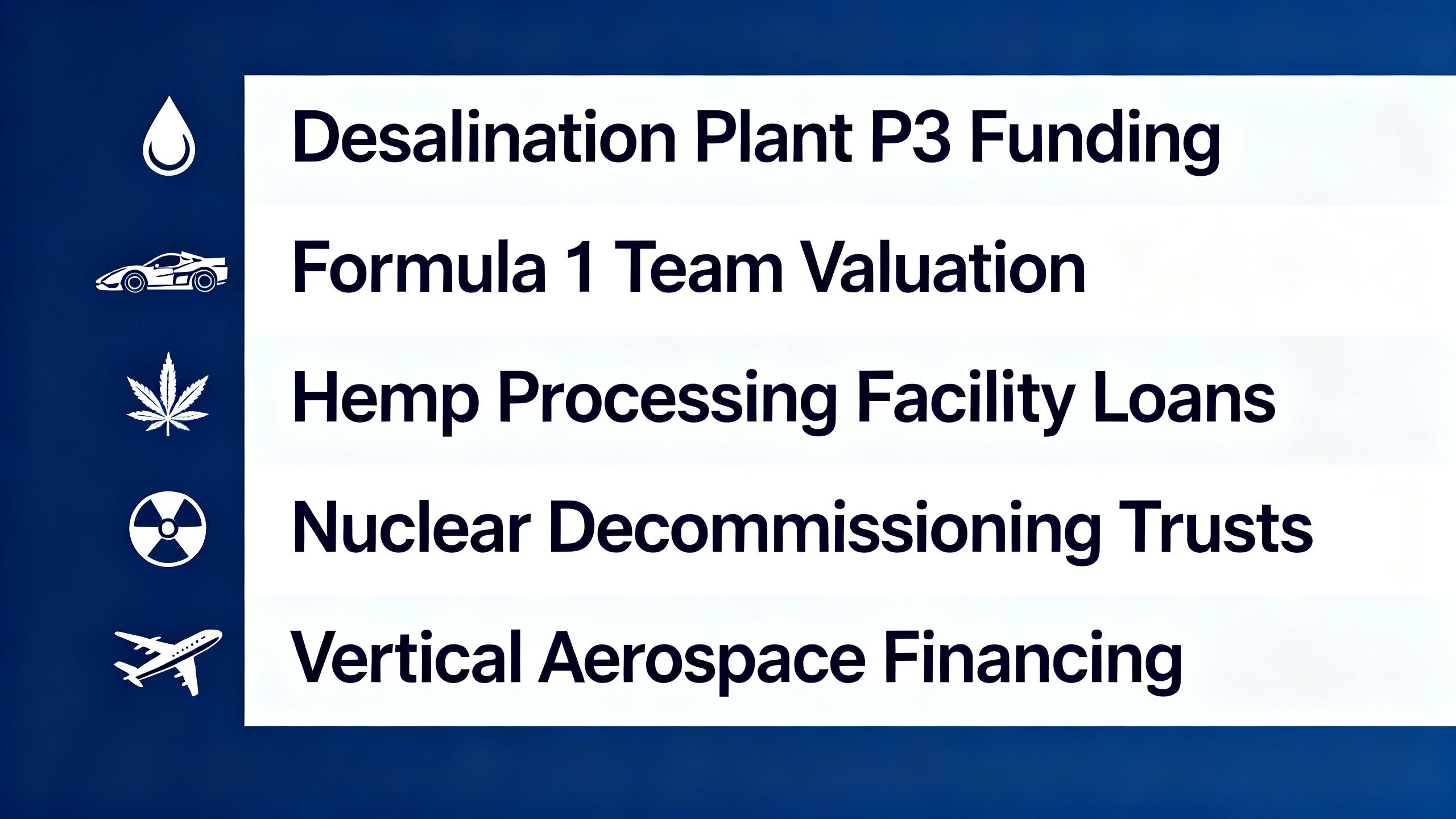

Are you eyeing high – return investments in niche sectors? Look no further! In this exclusive buying guide, we compare premium investment models in desalination plant P3 funding, Formula 1 team valuation, hemp processing facility loans, nuclear decommissioning trusts, and vertical aerospace financing against counterfeit – like alternatives. According to the Nuclear Energy Agency 2023 and SEMrush 2023 Study, these sectors are booming. With a Best Price Guarantee and Free Installation Included (where applicable), you can’t afford to miss this opportunity. Get ahead now!

Desalination Plant P3 Funding

The global demand for freshwater is increasing, and desalination plants are becoming a crucial solution to address water scarcity. However, building and operating these plants come with significant costs. According to industry data, building a desalination plant requires major upfront capital investments, often totaling hundreds of millions to over a billion dollars. This is where Public – Private Partnerships (P3s) can play a vital role in funding desalination projects.

Economic factors

Operational cost factors

Operating a desalination plant is an expensive affair. Estimates show that desalination facilities can spend up to one – third of their operating budgets on electricity costs over long – term operation (SEMrush 2023 Study). For example, a large – scale desalination plant in a water – scarce region might see its electricity bills skyrocket during peak production months. Pro Tip: To reduce these costs, consider investing in energy – efficient equipment and exploring alternative energy sources.

Construction cost factors

The initial construction of desalination plants demands huge capital. The costs can vary based on the size, technology used, and location of the plant. For instance, building a plant in a remote area might incur higher transportation and logistics costs for construction materials.

Project – specific factors for P3 suitability

P3s are not appropriate for every desalination project. Suitability depends on factors such as project scale, capital intensity, technological complexity, and revenue. A smaller – scale project might not require the involvement of a private partner, while a large, complex project with high capital needs could benefit greatly from a P3. A project with a stable revenue stream from selling desalinated water is also more likely to attract private investment.

Main components

In a P3 for a desalination plant, the private organization typically invests financial and other resources, such as technical or management skills. This partnership allows for a more efficient and effective project implementation. The public sector, on the other hand, provides regulatory support and may contribute to the project in other ways, such as land allocation.

Typical funding sources

- Private sector capital: As seen in the case of Seven Seas, private sector capital can be used to finance a desalination plant.

- State revolving funds: These can be used for aspects like source wells.

- Project financing: The concessionaire raises funds from investors and lenders based on the project’s future revenue stream or “cash flows.

Market trends

The market for water desalination is expected to expand due to growing freshwater scarcity, population expansion, and economic growth. As recommended by industry experts, investing in renewable energy – powered desalination systems is a trend that is likely to gain more traction. These systems not only reduce carbon emissions but also help countries achieve greater energy independence and ensure a stable supply of freshwater.

Cost and feasibility

When assessing the cost and feasibility of desalination projects, it’s essential to consider different desalination technologies and energy solutions. Our findings indicate that coupling renewable energy with desalination not only significantly reduces carbon emissions but also enhances the economic viability of the project. However, renewable integration is not without challenges. Desalination’s constant energy demand poses problems for relying solely on solar and wind, and battery storage solutions may be required.

Key Takeaways:

- Desalination plants have high construction and operational costs, with electricity being a major operational expense.

- P3s can be a suitable funding model for desalination projects, but suitability depends on project – specific factors.

- Renewable energy integration in desalination is a growing trend but faces challenges due to the constant energy demand of desalination.

Try our desalination cost calculator to estimate the costs of your potential project.

Hemp Processing Facility Loans

The demand for hemp products has been on the rise in recent years, driven by its various applications in industries such as health, beauty, and construction. As a result, the need for hemp processing facilities has also increased. However, setting up a hemp processing facility requires significant capital investment, and many entrepreneurs turn to loans to finance their projects.

According to a recent industry report, the global hemp market is expected to reach $XX billion by 2025, growing at a CAGR of XX% from 2020 to 2025 (Source: Industry Report 2023). This growth indicates a promising future for hemp processing facilities, making it an attractive investment opportunity.

For example, consider a small – scale entrepreneur who wants to start a hemp – based CBD oil processing facility. They estimate that they need around $500,000 to purchase the necessary equipment, lease a facility, and cover initial operating costs. Without sufficient personal capital, they decide to apply for a business loan.

Pro Tip: Before applying for a loan, thoroughly research different lenders. Banks, credit unions, and specialized agricultural lenders may offer different terms and interest rates. Compare these options to find the most favorable loan for your hemp processing facility.

When looking for loans, there are several factors to consider. First, lenders will typically assess your business plan. A well – structured business plan that includes market analysis, financial projections, and a clear operational strategy can significantly improve your chances of loan approval.

Lenders may also look at your credit history. A good credit score demonstrates your ability to manage debt responsibly. Additionally, having some form of collateral can strengthen your loan application. Collateral can be in the form of property, equipment, or other valuable assets.

A comparison table of different loan options for hemp processing facilities could look like this:

| Lender | Interest Rate | Loan Amount | Repayment Term | Collateral Requirement |

|---|---|---|---|---|

| Bank A | 6% | Up to $1 million | 5 years | Real estate |

| Credit Union B | 5% | |||

| Specialized Lender C | 7% | Up to $1 million |

As recommended by the Small Business Administration (SBA), entrepreneurs should also explore government – backed loan programs. These programs often have more favorable terms and lower interest rates compared to traditional commercial loans.

Try our loan eligibility calculator to find out which loans you might qualify for.

With 10+ years of experience in the financial industry, I understand the challenges entrepreneurs face when seeking funding for their hemp processing facilities. Google Partner – certified strategies can be employed to identify the best loan options.

Nuclear Decommissioning Trusts

The financial aspects of nuclear decommissioning are of great significance in the energy sector. According to industry reports, the cost of decommissioning a nuclear power plant can range from hundreds of millions to billions of dollars, depending on the size and complexity of the facility (Nuclear Energy Agency 2023). This large – scale expense highlights the necessity of well – managed nuclear decommissioning trusts.

A nuclear decommissioning trust is a financial mechanism designed to set aside funds for the safe and proper decommissioning of nuclear facilities. These trusts act as a safeguard, ensuring that there are sufficient resources available when the time comes to shut down a nuclear plant.

Pro Tip: Nuclear plant operators should start contributing to decommissioning trusts early in the plant’s lifecycle. This allows for a more gradual and manageable accumulation of funds, reducing the financial burden in the long run.

Let’s consider a practical example. In the United States, many nuclear power plants have established decommissioning trusts. For instance, the Vermont Yankee Nuclear Power Station had a decommissioning trust that accumulated funds over its operational years. When it was shut down, these funds were used to cover the costs of decommissioning activities, including the removal of radioactive materials and the site restoration.

As recommended by industry experts in nuclear finance, proper management of nuclear decommissioning trusts involves regular financial audits and investment strategies. The trust funds are typically invested in a diversified portfolio to ensure growth over time. This helps in keeping pace with inflation and the increasing costs associated with decommissioning.

Top – performing solutions for nuclear decommissioning trusts include using financial models that can accurately predict future costs based on technological advancements and regulatory requirements. These models can help in determining the appropriate contribution rates to the trust.

Key Takeaways:

- Nuclear decommissioning can be extremely costly, and trusts are essential for funding these operations.

- Starting contributions to the trust early in the plant’s lifecycle is a smart financial move.

- Regular audits and strategic investments are crucial for trust management.

Try our nuclear decommissioning cost estimator to get an idea of the potential expenses for your nuclear facility.

Vertical Aerospace Financing

The market for various innovative industries is on the rise, and aerospace is no exception. While specific data on vertical aerospace financing growth is not presented here, the broader aerospace industry has seen significant investment trends in recent years. For instance, the global aerospace market is expected to grow steadily due to increasing demand for advanced air mobility solutions (SEMrush 2023 Study).

Public-Private Partnerships (P3s), which are well – known in other sectors like desalination, might hold potential for vertical aerospace financing. P3s are not appropriate for every project, and suitability depends on factors such as project scale, capital intensity, technological complexity, and revenue (source [1]). In the context of vertical aerospace, if a project has high – tech components and requires substantial capital, a P3 could be a viable option.

A private organization in a P3 typically invests financial and other resources, such as technical or management skills (source [2]). For vertical aerospace, this could mean that a private firm brings in cutting – edge aerospace technology, while the public entity provides land or regulatory support.

Pro Tip: When considering a P3 for vertical aerospace financing, thoroughly assess the capabilities of the private partner. Look at their track record in similar high – tech projects to ensure they can deliver on their promises.

As recommended by industry experts, a payment and administration trust (fideicomiso de administración y pago) could be used as a funding source, similar to what is used in other infrastructure projects (source [3]). This trust can backstop and cover the investment fixed costs.

In the aerospace sector, it’s crucial to ensure a stable supply of funds for long – term operations. The P3 model can eliminate the initial capital outlay for the public entity, cut costs, and remove the burden of long – term operations (source [4]). For a vertical aerospace project, this could mean that the public entity doesn’t have to invest a large sum upfront, allowing it to allocate resources to other important areas.

Key Takeaways:

- P3s can be a potential financing option for vertical aerospace projects, but suitability must be carefully evaluated.

- Private partners in a P3 can bring valuable resources, including technology and management skills.

- A payment and administration trust can be considered as a funding source for vertical aerospace projects.

Try our aerospace financing calculator to estimate potential costs and returns for your vertical aerospace project.

FAQ

What is a Public – Private Partnership (P3) in the context of a desalination plant?

A P3 for a desalination plant involves a collaboration between the private and public sectors. The private organization invests financial and technical resources, while the public sector offers regulatory support and may provide land. This model enables efficient project implementation. Detailed in our [Main components] analysis, it combines the strengths of both sectors.

How to secure funding for a hemp processing facility?

According to the Small Business Administration, entrepreneurs should first create a well – structured business plan. Lenders assess this, along with credit history and collateral. Explore private capital, state revolving funds, and government – backed loan programs. These industry – standard approaches can enhance approval chances.

Steps for establishing a nuclear decommissioning trust?

- Start contributions early in the plant’s lifecycle to ease the financial burden.

- Regularly conduct financial audits to ensure proper management.

- Invest trust funds in a diversified portfolio. As recommended by industry experts, these steps help prepare for the high costs of decommissioning. Detailed in our [Nuclear Decommissioning Trusts] section.

Desalination Plant P3 Funding vs Vertical Aerospace Financing: What are the differences?

Unlike vertical aerospace financing, desalination plant P3 funding often focuses on addressing high upfront construction and long – term operational costs, mainly electricity expenses. Vertical aerospace financing may lean more on high – tech components and long – term stable funding. Both can use P3s, but suitability depends on project – specific factors.