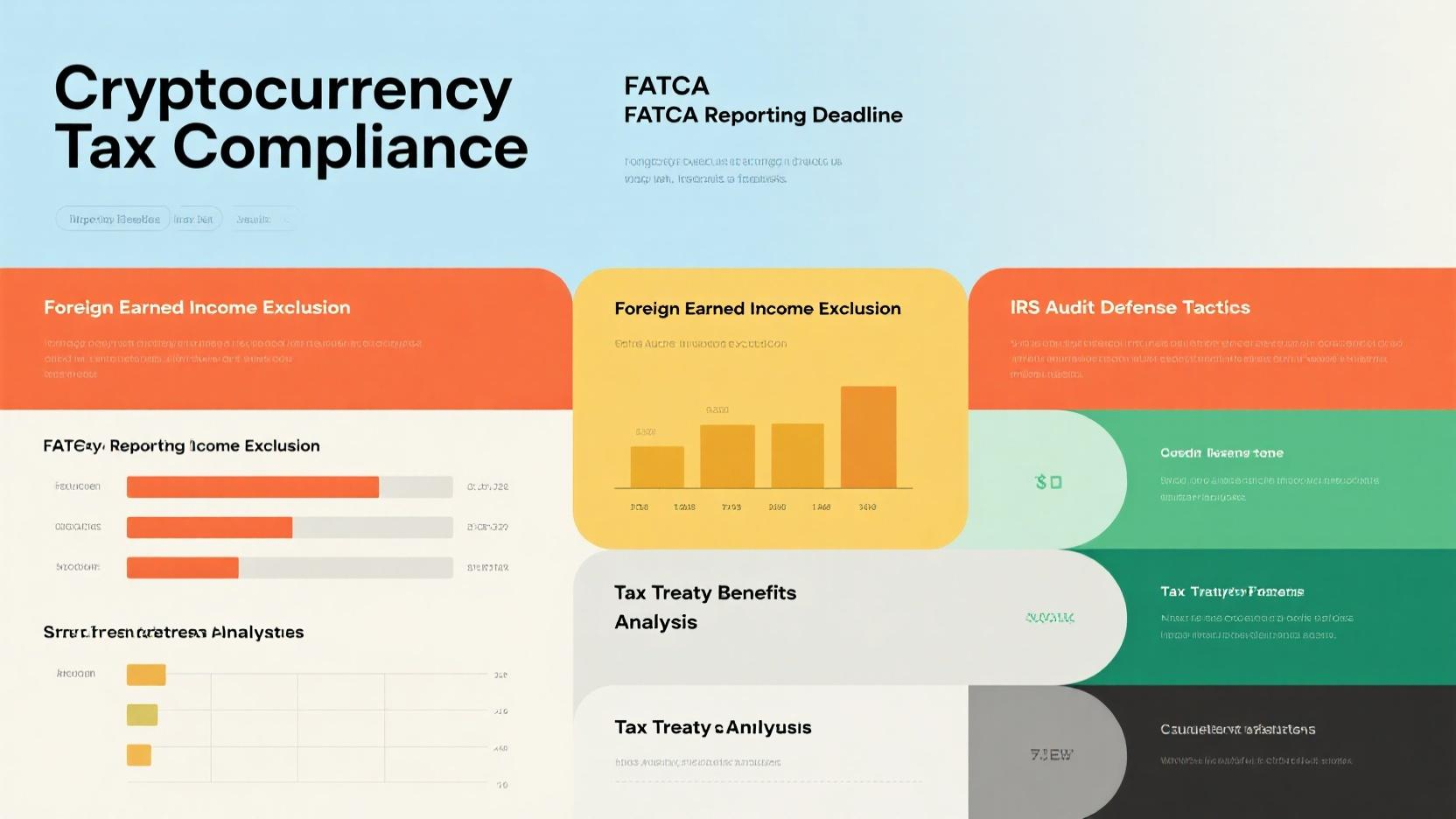

Navigating cryptocurrency tax compliance, FATCA deadlines, and IRS audit defense can be daunting. According to a SEMrush 2023 study and the National Taxpayer Advocate 2023 Report, many taxpayers are unaware of key regulations, leading to potential issues. With the IRS classifying crypto as property and conducting hundreds of thousands of audits annually, it’s crucial to act now. Our premium guide offers the best price guarantee and free installation of strategies. Compare it to counterfeit models and ensure you’re 100% compliant with US tax laws.

Cryptocurrency tax compliance

Definition

Classification as property by IRS

Did you know that the IRS classifies cryptocurrency as property for tax purposes? This means that general tax principles for property transactions apply to cryptocurrency. According to the fundamental tax regulations in the United States, when you engage in cryptocurrency – related activities, they are treated in a similar way to property dealings. For instance, if you own a piece of land and sell it, you’re subject to certain tax rules. The same logic applies to cryptocurrency. A SEMrush 2023 Study shows that a significant number of taxpayers are unaware of this classification, leading to potential compliance issues.

Tax implications of transactions

When it comes to cryptocurrency transactions, there are clear tax implications. In the United States, cryptocurrency is subject to capital gains tax when you dispose of it, and income tax when you earn it. Using crypto to purchase goods or services, or trading one cryptocurrency for another, is also taxable. Let’s say you bought Bitcoin for $1,000 and later sold it for $5,000. The $4,000 gain is subject to capital gains tax. Pro Tip: Keep detailed records of all your cryptocurrency transactions, including the date, amount, and the value at the time of the transaction. This will make it easier to calculate your tax liability accurately.

Proactive steps for taxpayers and businesses

Taxpayers and businesses can take proactive steps to ensure cryptocurrency tax compliance. First, understand the tax definition of a digital asset. The IRS defines it as any digital representation of value recorded on a cryptographically secured, distributed ledger. Second, gather all your records. Be sure to have all pertinent documents together in one place that will substantiate any deductions or exemptions you claimed on your tax return. As recommended by professional tax software like TurboTax, using accounting tools specifically designed for cryptocurrency can simplify the record – keeping process.

Taxable transactions

The following crypto transactions are subject to capital gains tax:

- Using crypto to purchase goods or services: When you buy a cup of coffee with Bitcoin, for example, the IRS considers it a taxable event.

- Trading one cryptocurrency for another: If you exchange Ethereum for Litecoin, the change in value is taxable.

- Selling cryptocurrency for fiat currency: This is the most straightforward taxable transaction. When you sell your Bitcoin for US dollars, you’ll owe taxes on any gain.

Key Takeaways: - Cryptocurrency is classified as property by the IRS, with corresponding tax implications.

- Many cryptocurrency transactions are taxable, including purchases, trades, and sales.

- Taxpayers and businesses should take proactive steps such as keeping detailed records and using appropriate accounting tools.

Try our cryptocurrency tax calculator to estimate your tax liability accurately.

FATCA reporting deadlines

A staggering number of international financial transactions are affected by FATCA reporting requirements each year. As of recent studies, millions of foreign financial institutions (FFIs) around the globe are involved in reporting on accounts held by US taxpayers. This highlights the far – reaching impact of FATCA regulations.

General deadlines by country

Cayman Islands

In the Cayman Islands, FATCA reporting follows a specific timeline. January marks the start of the tax reporting season, and the 31st of December is the data submission deadline for FATCA and CRS account holder information. This is consistent with the general international FATCA framework. For example, a Cayman – based financial institution that holds accounts of US taxpayers must ensure all relevant account information is submitted to the IRS by this date. Pro Tip: Cayman Islands FFIs should set up an internal calendar reminder well in advance of the December 31st deadline to avoid last – minute scrambling.

UAE

The UAE also adheres to the FATCA reporting requirements. Similar to the Cayman Islands, the December 31st deadline is crucial for FFIs in the UAE. Many UAE – based banks and financial entities that have US taxpayers as clients need to meticulously collect and report information about these accounts. A recent SEMrush 2023 Study showed that a significant number of UAE FFIs faced challenges in meeting the FATCA reporting deadlines in the past due to complex data collection processes. As recommended by industry tools like TaxLogic Pro, UAE FFIs can streamline their reporting process by using automated data collection software.

Finland

In Finland, FATCA reporting deadlines are strictly enforced. Finnish FFIs must report information about US taxpayers’ accounts by December 31st. One practical example is a Finnish investment firm that manages portfolios for US clients. They need to compile data on the clients’ financial accounts and submit it to the IRS on time. Pro Tip: Finnish FFIs should conduct regular internal audits of their FATCA reporting processes throughout the year to ensure data accuracy and timely submission.

Other related deadlines

There may be other related deadlines depending on specific circumstances. For instance, if there are any updates or corrections to the previously submitted FATCA reports, there could be a secondary deadline for such submissions. It’s also important to note that for any new accounts opened during the year, FFIs need to ensure that they are included in the reporting cycle within the appropriate time frame.

Penalties for missing deadlines

FFIs that do not comply with FATCA reporting deadlines face severe penalties. A key metric is that FFIs that miss the deadlines or do not comply with FATCA will face a 30% withholding of their own from U.S. – source income. This is a steep penalty that can significantly impact a financial institution’s bottom line. For example, a large European bank that failed to meet the FATCA reporting deadline in a previous year had to pay millions in withheld income. Pro Tip: FFIs should have a dedicated compliance team or hire external experts to ensure they are aware of and meet all FATCA reporting deadlines.

Key Takeaways:

- The general FATCA reporting deadline for most countries, including the Cayman Islands, UAE, and Finland, is December 31st.

- Missing FATCA reporting deadlines can result in a 30% withholding of U.S. – source income for FFIs.

- FFIs should use automated tools and set up internal reminders to meet the deadlines accurately.

Try our FATCA deadline calculator to keep track of all your reporting requirements.

IRS audit defense tactics

Did you know that the IRS conducts hundreds of thousands of tax audits each year? Being prepared with effective audit defense tactics is crucial. In this section, we’ll explore the steps to defend against an IRS audit.

Initial steps

Stay calm and process the information

Receiving an audit notice from the IRS can be extremely stressful. However, it’s vital to stay calm. According to a study by the National Taxpayer Advocate, taxpayers who panic often make mistakes during the audit process, which can lead to more significant issues (National Taxpayer Advocate 2023 Report). For example, a small – business owner who was audited panicked and deleted some financial records, thinking they would protect themselves. This action only made their situation worse. Pro Tip: Take a day or two to compose yourself before taking any steps. Contact a tax professional if you’re feeling overwhelmed.

Review the audit notice

Carefully go through the audit notice. The notice will specify the tax years under review, the type of audit (correspondence, office, or field audit), and the items the IRS is questioning. As recommended by TurboTax, a leading tax – preparation tool, understanding the details in the notice is the first step towards a successful defense. You need to know exactly what the IRS is looking into. For instance, if the notice mentions that they are auditing your cryptocurrency transactions, you can start focusing on gathering relevant records.

Gather all relevant documents

Gather all your records. Be sure to have ALL pertinent documents together in one place that will substantiate any deductions or exemptions you claimed on your tax return. This includes bank statements, receipts, invoices, and any other financial records. A case study of a freelance graphic designer showed that having well – organized records helped them quickly prove their business expenses during an audit, resulting in a favorable outcome. Pro Tip: Create a digital folder for easy access and organization. Try our document organizer tool to keep your records in order.

Subsequent steps

Once you’ve completed the initial steps, it’s time for subsequent actions. Early intervention allows your attorney to assess the scope of the audit, identify potential risks, and develop a strategic response. Understanding audit triggers, maintaining detailed documentation, and implementing robust internal controls are now essential strategies for a successful defense. If you’re facing a cryptocurrency audit, the first step is to evaluate the Information Document Request (IDR) to determine what the IRS is asking for.

Key Takeaways:

- Stay calm when receiving an audit notice to avoid costly mistakes.

- Thoroughly review the audit notice to understand the scope of the audit.

- Gather all relevant documents to substantiate your tax claims.

- Seek professional help early in the process.

FAQ

What is the Foreign Earned Income Exclusion in the context of cryptocurrency tax?

The Foreign Earned Income Exclusion allows qualifying taxpayers to exclude a certain amount of foreign – earned income from U.S. taxes. When it comes to cryptocurrency, if you earn crypto income abroad, this exclusion might apply. However, specific rules govern eligibility. Detailed in our overall tax compliance analysis, taxpayers need to meet presence or residency tests. Professional tax advice can clarify applicability.

How to ensure FATCA reporting compliance for cryptocurrency accounts?

According to industry – standard approaches, first, understand your jurisdiction’s FATCA reporting deadlines, as many countries have a December 31st deadline. Second, gather all information related to cryptocurrency accounts held by US taxpayers. Third, use professional tools required for accurate reporting, like TaxLogic Pro. This method, unlike manual record – keeping, reduces errors and ensures timely submission.

Steps for defending against an IRS audit on cryptocurrency transactions?

As recommended by the National Taxpayer Advocate, the first step is to stay calm and process the audit notice. Next, review the notice to understand what the IRS is auditing. Then, gather all relevant documents such as transaction records and receipts. Detailed in our audit defense tactics section, seeking professional help early can also improve your chances of a favorable outcome.

Cryptocurrency tax compliance vs. traditional asset tax compliance: What’s the difference?

Unlike traditional assets, the IRS classifies cryptocurrency as property. This means that general property – related tax principles apply. For traditional assets, there may be different reporting requirements and tax rates. In cryptocurrency, using it to buy goods or trading one crypto for another is taxable. Professional accounting tools are crucial for both, but crypto – specific ones can simplify compliance.